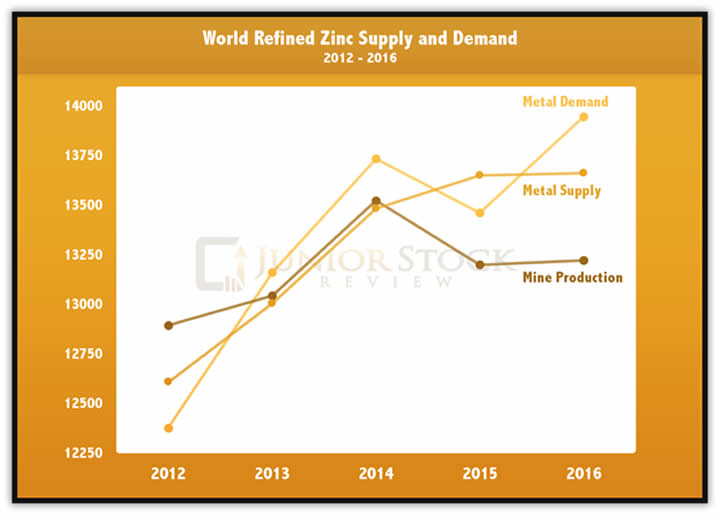

Dear Reader, Which is vanishing at an alarming rate. Demand is rising... supply is disappearing... and its price is projected by the World Bank to quickly rise 44% from its recent lows. And continue up from there. And, as that happens, the miners of this extraordinary metal will reward investors as they rise multiples higher. Why? This metal is of STRATEGIC importance to every country on Earth. Reuter’s reports China is hoarding it for their superhighway plan to connect China and Europe. It’s also central to India's 7 Megacity plan. And, MOST IMPORTANTLY, this “military metal” is central to Trump's infrastructure plan... Especially critical to building 78 new Navy ships... because it's an essential component of galvanized steel. In our latest analysis, you can discover everything you need to know about the coming Zinc supercycle... And get the names and ticker symbols of the miners that will profit... Including the one that we believe will profit most, Zinc One (TSX-V:Z; OTC:ZZZOF). Zinc One just got control of what might be the last best motherlode of the metal in the world... Peru’s Bongara Mine. It’s...

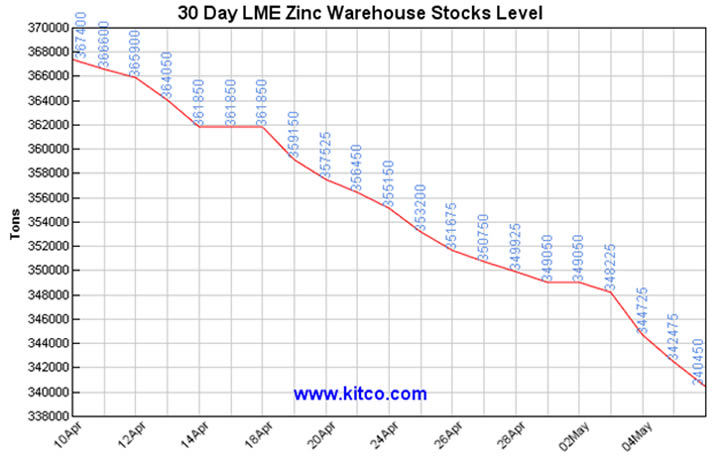

In fact, it’s such an incredible opportunity that a former Barrick Gold mine manager saw the potential and was lured away to oversee the project. In our opinion it’s an incredible opportunity for investors. That’s because during Zinc’s last super-cycle investors in the base metal saw Zinc rise 400%... with small miners paying out multiples more. When demand is weak, zinc stockpiles build and prices collapse. And when prices of the commodity fall low enough, it isn’t cost effective to pull the metal out of the ground. Zinc mines have been closed. There is a lot less of the metal available when demand eventually increases. Industry insiders call it the commodities cycle. That’s what has happened over the past few years... but Zinc One has been quietly waiting.

Rising demand for Zinc as a STRATEGIC metal is happening NOW...

And these Zinc miners... especially Zinc One …are poised to profit. Why Zinc One?

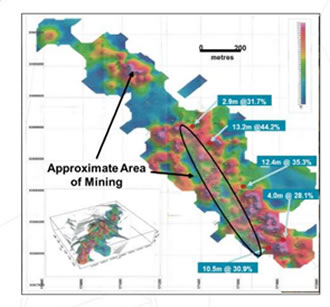

But Zinc One’s Bongará deposit has 2.5 times higher grade zinc in it. Zinc makes up over 20 percent of the deposit. And in some areas, zinc concentration is as high as 44 percent. A higher concentration in the ground at surface reduces Zinc One’s extraction costs and increases profits. Once it is back in production, the Bongará Mine Project will be one of if not the highest-grade zinc mine in the world. At a minimum, it will be in the top 1 percent for grade of the world’s roughly 1,500 deposits the Company reviewed. Better still, it’s located in politically friendly Peru and past production records show greater than 90 percent of the zinc is recoverable. Plus... cashed up... Zinc One (TSX-V:Z; OTC:ZZZOF) is also aggressively acquiring and exploring nearby analogous geology to bring in more shareholder value. We expect a substantial amount of news flow from this company in the coming days, weeks and months... Including announcements on permits, the drilling of up to 400 holes, and potential increases in resource estimates. Quick... Get the full story now...

By James Burgess of Oilprice.com

You're receiving this Email because you have subscribed to our newsletter. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

Many zinc deposits are found deep underground and contain just 5 percent-8 percent zinc grades.

Many zinc deposits are found deep underground and contain just 5 percent-8 percent zinc grades.