The Year of Mass Distraction Ends, Stocks, Gold, Oil and the Bitcoin Craze 2018 Dear Reader, 2017 proved to be a year of mass distractions. There was Trump the con man who promised everything but delivered near nothing. though that did not stop him from claiming success in everything! However he remains very entertaining with his mad tweets and rhetoric of unleashing nuclear war that the mainstream media were more than eager to regurgitate 24/7. So the greatest weapon of mass distraction of 2017 was being engrossed in the actor playing the part of being President of the United States. A year of twitter storms and war of words especially against North Korea's 'little rocket man': “If the US is forced to defend itself or its allies, we will have no choice but to totally destroy North Korea.” “Rocket man is on a suicide mission for himself and his regime". However, despite the Trump reality show not come as any surprise given the fact that I expected as much since BEFORE Trump won the November 2016 US Presidential election. Nevertheless the price paid for focusing on the Trump reality show was one of being distracted from that which actually matters - The MARKETS! And then there was the other weapon of mass distraction BREXIT! Which saw Britain's inept and clearly way out of her depth Prime Minister scrambling from one mishap to another as she increasingly literally sucked her neck into her shell, trying to hide from the mess she created in the infamous snap general election of June despite bad economic indicators for holding an election at that time i.e. falling real terms earnings. And apparently Theresa May is the best of the rabble that currently occupies West Minister, so despite the fact that she failed abysmally and should have resigned, there just appears to be no one of any caliber to lead Britain through the BREXIT minefield so expect this train wreck to continue coming off the rails during 2018. And if those weren't bad enough then there was my growing obsession with the saga of our mad city council deciding that thousands of Sheffield's trees needed to be felled as a matter of urgency, amounting to stripping the streets of their pollution cleansing lungs, each with capital values of between £50k and £150k per tree that directly contributed to the ending of Sheffield's housing bull market by mid 2017 and which looks likely to have triggered a local house prices crash of at least 5% once the data is in. The following video gives a taste for how much time and energy I expended on this weapon of mass distraction, as the city council's contractor literally imported an army of Arb's from the South and HiViz bouncers from the North all to fell Sheffield's street trees that by December had street scenes resembling something out of an eastern european pseudo democracy. So for me, 2017 proved to be a year of being hit by multiple weapons of mass detraction from that which had always mattered the most - Analysis of the FINANCIAL MARKETS! From Stocks to gold & silver to oil, even the bitcoin bubble mania were ALL mostly side-lined in favor of what in large part were side shows! And as analysis of Trump and Brexit illustrated that what I term as sub components i.e. at best secondary factors just cannot be relied on to extrapolate for instance stock market trends. For it clearly JUST DOES NOT WORK! That is the main lesson learned from 2017. Then there was my failure to revisit the US housing market despite the fact that my multi-year analysis and concluding trend forecast by far proved to be the most accurate of any housing market forecast out there, so 2017 should have seen in-depth analysis concluding in a multi-year trend forecast for US house prices. Another area that remained firmly stuck on the back burner was my failure to convert any of my analysis in the machine intelligence mega-trend into articles and videos for the whole of 2017, despite THIS being one of the PRIMARY mega-trend drivers for the coming decades. So my resolution for 2017 is clear, I need to ignore Trump, Brexit, and the probable next snap general election and forget about the plight of Sheffield's f-ing trees! Instead focus on that which actually matters! THE FINANCIAL MARKETS and INVESTING IN THE MACHINE INTELLIGENCE MEGA-TREND. Therefore my focus is now firmly on the following series of in-depth analysis over the coming days, weeks and months toward arriving at high probability trend forecasts:

NO Trump, Brexit or Trees! So with that said, here is my first look at what to expect for several markets as we begin 2018. Dow Stock Market Trend Expectations Early 2018 2017 surprised most including myself by turning out to be one of the greatest years of the past decade for stock investors, traders and gamblers as bull markets appeared everywhere as the financial markets basically discounted Trump as an irrelevance, a side-show for the masses to be distracted by and focus upon whilst the wealthy continued to concentrate each nations wealth into their own hands. The Dow ended the year at 24,719, up 4,957 points for an exceptionally strong 25% gain, a remarkable performance for what at the start of the year was seen as being a mature 8 year old bull market. Whilst the S&P gained 19% and the Nasdaq 29%. With the FTSE lagging behind for a 15% gain. Which given where we began the year and the chaos that the BrExit election wrought is definitely nothing to complain about for UK investors!

A quick look at the Dow chart shows that despite being overbought, the Dow is not showing signs for an imminent demise to this stocks bull market. Whilst the most probable trend likely to materialise over the first few months of 2018 is for the Dow to revert back down towards hugging the central trendline that currently stands at very distant 23,000. So ahead of my in-depth analysis I would not be one for expecting the Dow's December surge to continue during January, instead expect the Dow to unwind its overbought state.

However the risks to this expectation are that the stock market could be about to enter a terminal bubble phase and go parabolic to well beyond what can be determined from chart analysis as illustrated by what Bitcoin did during 2017. Crude Oil 2017 $60 Forecast Achieved, $80 Next for 2018? Bullish commodity traders and investors in the likes of oil and gold also saw strong positive returns for the year as Oil ended at its high for the year of $60 inline with my bullish expectations for 2017. In terms of the immediate outlook for oil, the price has broken out of a year long range capped at $56 that it will likely revisit (test) during the next few weeks. Though oil is clearly in a bull market and thus I expect the bullish trend to continue and would not be surprised if we see crude oil break above $80 during the year!

Gold Achieves $1375 2017 Target, $1500 Expected for 2018 Gold had a bumpy but positive year, ending at $1310, up a healthy $160 pr 14% on the year which is inline with my bullish expectations for the precious metal. In fact Gold virtually hit my exact high target for the year of $1375 in September before correcting ahead of its end of year rally to $1310. My long-term forecast expectations remain as of more than a year ago that Gold ultimately targets a trend towards $1800, a trend that is pending a break above $1375. As for Gold in 2018, a break above $1375 should see the Gold price target $1500, an expectation I will come back to in an in-depth analysis of Gold and Silver in the coming weeks. Bitcoin Crash Not Over, Crypto Gamblers Prepare for Spike Down to $5,000 The crypto gamblers have had a wild ride during during 2017 where early year bets on Bitcoin at sub $2000 for the first 4 months of the year convert into a $20k Mid December bubble peak! Whilst I had no interest in bitcoin or any other of the crypto's, I did pay some attention to its rise later in the year because so many people kept asking me how to buy, hold and trade bitcoins, and later still I kept being asked when they should sell, right upto the day bitcoin peaked at $20k! And then came the inevitable crash to 10k, with the bitcoin as of writing recovering to trade at USD 13,300.

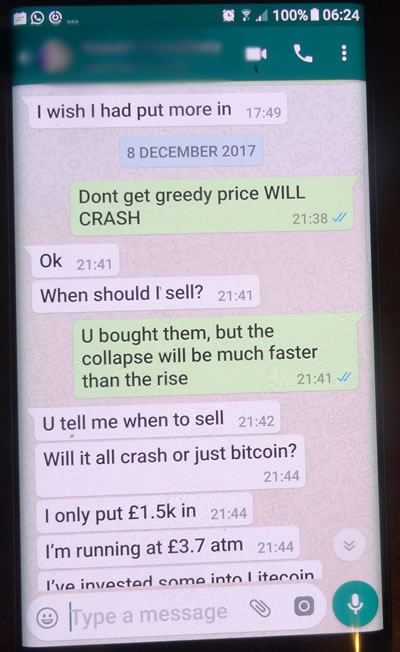

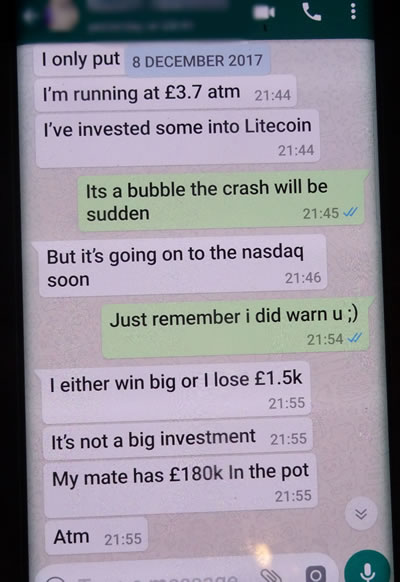

In the run up to $20k, many bitcoin investors / gamblers would ask me online and in real life "when they should sell their bitcoin holdings" and my reply tended to be that I've not been interested in bitcoin for several years, it's just a gamble, there's nothing backing it, and there is a high risk your bitcoins will be stolen right from your exchange accounts as has happened several times over the past decade, in fact I warned about such practices near 4 years ago of how bitcoin exchange scams tend to work. 02 Mar 2014 - Bitcoin the Perfect Scam, Price Does Not Reflect True Dangers of Holding Bitcoins - Bitcoin Exchanges are a Ponzi Scam The bitcoin exchanges have been busy distancing themselves from MTGox as if they are something different, more trustworthy, when the truth is they are the SAME - NO DIFFERENT! In fact you are all being duped for they are not really exchanges at all! They are NOT akin to the stock exchange or commodities exchange but just websites that some techies set up that may have started out honest but greed will get the better of them just as it did with MTGox because as MTGox illustrated the prices being quoted are meaningless, there is no volume! Unregulated Bitcoin exchanges are the natural consequence of the crypto currency scams for their primary purpose is to entice new entrants to buy bitcoins that the exchanges say they hold. How do they achieve this ? They do it by producing fancy trading graphs that show the price of bitcoins as rising and being high which encourages the fools to send the exchanges their hard earned money that they will never see again! This is what the exchanges do, they get fools to send them money for bitcoins that allegedly NEVER existed, this is why when MTGox went bust it stated that some 800,000 bitcoins disappeared when the truth is that they probably never existed! It is as I warned several months ago a PONZI SCAM! The exchanges pay out those selling / transferring their bitcoins out with money from new investors as long as new investors are greater than those exiting the ponzi scam continues. The bitcoin exchanges make it very easy to BUY bitcoins with them but make it near impossible to withdraw, transfer out, as their primary purpose is to suck as many investors into their vortex as possible. So watch this space for whether or not the authorities in Japan charge MTGox with being a Ponzi Scam. The Anatomy of CraptoCurrency Scams Take this as a concise guide as to how crypto-currency scams tend to work. 1. New crapto-coins craptocurrency is developed allowing the creator and his friends to easily mine approx 1/3rd of the total potential supply before going public. 2. Holders of crapto-coins agree to withhold their supply from the market before it goes public. 3. Start to promote the craptocurrency by handing out free crapto-coins to the media, with likes of Max Keiser at the top of the list to start pumping. 4. Crapto-coins start trading and immediately jump in price due to limited supply. 5. Illiquid crapto-coins have a high market capitalisation due to a high price and number of coins (not) in circulation which encourages more media exposure and interest. 6. Many fools jump on the bandwagon buying expensive hardware to mine crapto-coins given the high price per crapto-coins (over 90% of mined supply with-held from market). 7. Many websites appear that add the tag exchanges to them to give the air of authority that suck in entrants by producing graphs and data that gives the illusion of rising prices and volume of trading when in reality they are nothing more than Ponzi scams as they limit withdrawals. 8. As interest and prices continue to rise, the creator and his friends slowly offload supply onto the fools until the price crashes and the noobs have been bled dry or holdings vaporise MTGox style. 9. The crapto-coins hoarders wait for the dust to settle and noobs to be encouraged once more into buying as the price is stable and then repeat the dump and crash several times more. That's how Bitcoin and ALL craptocurrency scams work So whilst I did not know when the current bitcoin bubble would burst, However burst it most definitely WILL do which was my warning to all those who had piled into the bubble this year, and that it could happen at any time and that when the bubble does burst the decline will be far more dramatic then the rise and so it was highly likely that they would lose 50% or more from wherever the Bitcoin price peaked as the following whatsapp conversation illustrates.

As for what bitcoin could do during 2018, well the price may have recovered some 30% from $10k but I doubt that the decline is over, so it looks like bitcoin holders are in the calm before the next bitcoin storm, another down leg to well below $10k, probably a spike down to $5k! So Bitcoin gamblers beware!

In terms of in-depth analysis, I may come back to bitcoin at some point during the year, but it's never been a priority market in terms of analysis and trading. The only time I was really interested in bitcoin was during 2011/2012 when I was investigating mining bitcoins. At the time I estimated it would cost me about £5k to build a mining rig, and that it would likely churn out a couple of bitcoins per week. However I concluded at the time that I would not even be able to cover my electricity costs let alone recoup the £5k capital investment from the then sub $10 price, so the plan to mine was never implemented. Unfortunately I never seriously considered actually buying bitcoins because at that time the mindset of most participants was to MINE for FREE rather than to actually pay money to buy bitcoins. Which is probably why I remain reluctant to buy any crypto currency preferring to consider mining rather than buying.

In terms of what I would do now if I wanted to take the time to get back into crypto's. Well it would probably be to create my own crypto rather than mine any of the myriad of coins out there. In fact it now looks like its much easier to create ones own crypto currency today than it used to be to setup a bitcoin mining rig years ago! So many platforms trying to invite people to create their own crypto coins which obviously carries a price in terms of benefiting the platforms in exchange for ease of creating ones own crypto currency. Still that is what I would do. and you never know it may yet come to that. And a Happy and Properperous New Year to ALL! By Nadeem Walayat Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||