UK Ageing Population Demographics and House Prices Trend Forecast Dear Reader, This is the next analysis in a series that aims to conclude in a new multi-year trend forecast for UK house prices, this analysis takes a look at the impact of Demographics on the probable house prices trend over the next few years. But first a recap of my analysis to date that so far suggests to ignore mainstream press hysteria that warns of impending doom for Britains housing market, encouraged no less than the Government and Bank of England which warn to expect a 30% CRASH in UK house prices should the UK LEAVE the EU without a deal. Instead my analysis so far (first made available to patrons) continues to paint a picture for UK house prices to remain on an overall upward trend trajectory which this analysis focuses upon the impact of an Ageing population on house prices.

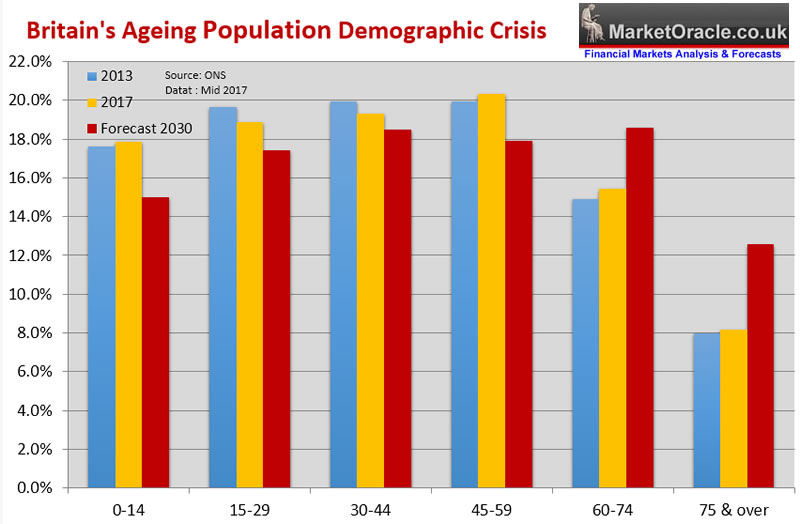

Britain's Demographic Time Bomb Has Gone Off! Britain's demographic crisis as illustrated by an ever growing ageing population that despite an increasing number of workers due to immigration cannot maintain worker to retiree ratios of the past, where 25 years ago there were 8.9 million pensioners against 28 million workers or a ratio of 3.15 workers to every retiree (15.5% of the total population), today there are over 12.5 million pensioners to 33.4 million workers, a ratio of 2.67 to every retiree (18.9% of the total population) which is already having an economic impact in terms of productivity and a drain on resources as Britain's growing elderly population demands an ever greater share of the economic pie, putting an ever increasing burden on the welfare state, services such as the NHS that will continue to severely impact on the economy consuming an ever increasing proportion of national resources.

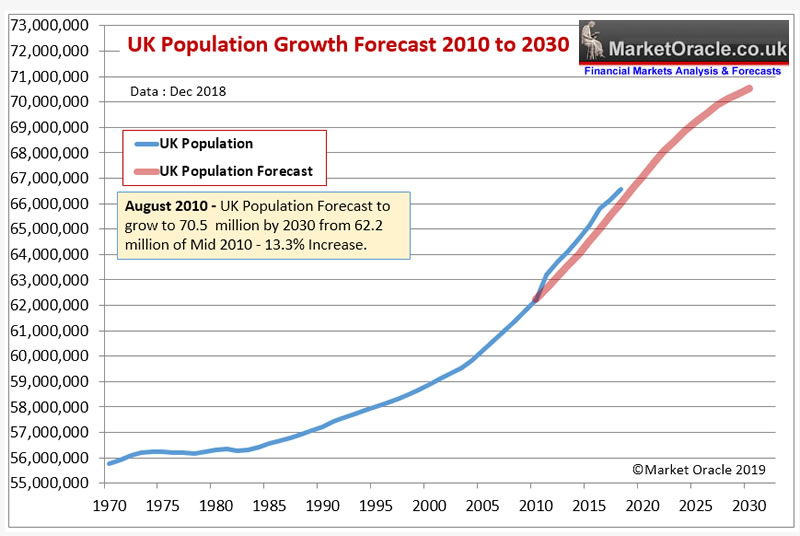

As my forecast graph illustrates there is no end in sight to Britain's demographics crisis as the UK looks set to see the number of retirees increase from approx 12.5 million today to 15 million by the end of 2030 the impact of which will partially be offset by Britains rising population from 62 million (2010) to at least 70 million by the end of 2030.

Which whilst putting Britain in a far better state than many other countries who's total population and worker base is already shrinking as well as experiencing increasing ageing populations such as Japan, Russia, Spain and Italy. Whilst it looks like Germanys open door immigration policy could save Germany from a similar fate to other European nations with falling populations. In fact I could do a whole separate analysis on how bad the demographic picture is for many if not MOST European nations. Which ironically makes a mockery of the recent anti-immigration rhetoric, which perhaps only ahead of the curve Germany recognised. Anyway most European nations are DIEING! For that is what it means when their populations are on a downwards trend trajectory as a consequence of poor fertility rates coupled with an ageing population. Which also suggests that one should AVOID investing in most European countries, especially eastern europe because most lack one of the fundamental drivers for rising house prices, a RISING population. Back to the UK, a 6% increase in total population against a 20% increase in retirees is only going to partially offset the economic impact of the increasing number of retirees as the ratio of workers to retirees continues to fall, especially as this trend looks set to continue well beyond 2030 by which time the number of over 75's looks set to nearly double in number, rising from 8% of the population today to more nearly 13% and in total approx 25% of Britain's population will be over 65 which suggests a ratio of 2.4 workers per retiree 1, that implies a further 10% loss of purchasing power of workers earnings over the next 15 years to pay for the growing retiree burden. The consequences of Britain's demographics are as I pointed out 9 years ago in the Inflation Mega-trend ebook of Jan 2010 (FREE DOWNLOAD), that governments have only ever have had one solution which is to PRINT MONEY be it called debt that will never be repaid or QE or a multitude of other examples such as Funding for Lending, and the consequences of the perpetual exponential money printing is as I have often written about is for continuous exponential inflation. This is why whenever I hear warnings of deflation I consider the proponents to be delusional because there has not been nor will there ever be persistent DEFLATION! Silver Lining of Sorts Thankfully it is not all gloom and doom as first the coalition government and then the Conservatives and likely future governments will increasingly recognise the exploding ageing population demographics time bomb and thus are actively engaged in attempts to alleviate the disastrous long-term consequences by both gradually raising the retirement age, which will probably be raised to 70 by 2030, as well as cutting the burden of costs that are presently being dumped onto the backs of tax payers as many pensioners cling on to million pound properties to pass down to their families rather than be utilised to finance care costs. Whilst both ends of the spectrum i.e. those retiring and those entering the workforce will feel outraged at their own increasing costs, and diminishing services, however there is no way out of the demographics crisis other than for unpopular policies to be implemented as the alternative would be for an hyperinflationary economic collapse, as successive weak governments keep delaying making the difficult decisions by taking the easy option of just printing money and monetizing government debt (as was the policy of the last Labour Government) which would wipe out the purchasing power of both earnings and savings and just give the illusion of growth as most people have experienced over the past 10 years, as the price paid for bailing out the banking crime syndicate. Other positive developments in recent years have been to address the problem of ageism so that people above a certain age are less likely to be seen as unemployable, the UK in this regard has come a long way over the past 15 years with now over 1.3 million pensioners working in retirement which coupled with extension of the retirement age should be seen as a positive trend until ultimately retirement will be resigned to the history books much as communism has been. After all retirement was never a sustainable social and economic policy as it was built upon the assumption that the ratio of workers to retirees would be sustainable at above X3, instead of the current trend towards below X2. Whilst more elderly in the workplace over recent years has resulted in an improvement in the overall economy in terms of productivity in utilising what would have been an idle workforce, however as mentioned earlier, it does not resolve the tax and debt burden being placed onto future generations, which does confirm my view that at some point the retirement age will be scrapped altogether and along with it the state retirement pension to be replaced with a form of income support for low paid elderly workers, along the same lines as today's emerging Universal credits system. Though the problem here is political as a growing elderly population is also more likely to vote and therefore carry's a far greater influence on government policies which is set to only increase with each passing year. Therefore political parties have little choice but to lie to the grey vote to get elected and then break their promises citing economic fundamentals. The objection put forward by many against an effective end to retirement is that it takes jobs away from the young, however this is a false premise as those starting out at the beginning of their careers are at a different stage of development than those that are in the last few years of their careers, just as those in their 40's usually do not compete against those in their 20's. Therefore even less so will those in their 60's and 70's, if anything it will allow for more efficient transfer of knowledge and experience between old and young workers rather than having an artificial cut off date. So whilst out of control immigration of the past 15 years has been very bad in terms consuming resources and drawing on in work benefits, it does however have a silver lining as the children of immigrants will bear the demographic burden (as will all born during the past 25 years), which will hopefully buy Britain time for its inept politicians and for technological advances to alleviate the consequences of which by 2030 could imply that 1.9 workers per retiree could be sustainable given the then emerging impact of machine intelligence on all aspects of human life. Though of course at some point the ageing population bulge will start to die out, unless machine intelligence delivers another leap in longevity, but for now I will leave analysis on the impact of that on house prices pending until the late 2020's. UK Real Unemployment Rate is 5.5 million Whilst the focus of this analysis so far has been the ratio of workers to retirees, however Britain also carries the burden of its benefits culture which has about 8.6 million people of working age who are sat idle, this is set against the official unemployment number of 1.4 million which results in an unrecorded economically inactive gap of 7.2 million which illustrates the true extent of the failure of the last Labour government to manage the potential of the work force during the boom years as illustrated by the fact that 80% of the 2.1 million jobs created under Labour went to foreign workers and therefore did nothing to address the true level of UK unemployment that contained a hidden ticking social security financing time bomb that has exploded as an extra £40 billion annual budget deficit that first the Coalition government and then the Conservative government has been focused on grappling with. Off course not all of those that are economically inactive can work such as through disablement or long-term illness, nevertheless the real level of unemployment if including those that can work but choose not to work is nearer to 5.5 million than the official level of 1.4 million. Therefore the Conservative government has been correct in recognising this huge and unsustainable burden on the state by attempting to implement measures such as Universal Credit to force those of working age to actively seek employment rather than remain a burden on the state for their entire working lives and then again during retirement, which would have the dual effect of turning many millions of today's benefit claimers into tomorrows tax payers. Impact of Demographics on UK House Prices The impact of Britain's demographics crisis on the UK Housing market suggests to expect an increasing supply from the mid to upper range of the UK housing market as many people approaching retirement will have during their working lives looked on their homes as a means of providing for them in their retirement as the expected rise on house prices as a consequence of inflation and economic growth to result in a profit far in excess of any outstanding mortgages at the time of retirement and in most cases they will have played the property market wisely and thus be sitting on a small fortune, especially those that bought in the South East of England over the past 20 to 30 years. Therefore a significant number of retirees look set to continue to either downsize or move into retirement homes and retirement villages that have been springing up, and maybe even new retirement towns will be built which in part will free up traditional housing supply and put a dampener on house price inflation of the likes of which we saw during the last boom whilst INCREASING demand for smaller properties in retirement towns and areas of the country such as sea-side towns. Furthermore the psychology of seeing ones property as a retirement investment is widespread amongst all ages so continues to act as an encouragement to buy properties as people continue to imagine that properties will always deliver huge gains as has been the experience of their parents and grand parents, one of an inexorable rise in house prices beyond that of purchasing power of earnings. In addition to this we have the wage slaves with less real terms disposable income to pay towards housing costs in terms of mortgages which on face value implies a persistent real terms deflationary outcome for UK house prices over the next 20 years. However this has to contend with what still amounts to rampant immigration coupled with domestic population growth as immigrant couples tend to have larger families which coupled with the benefit culture of having children for benefits will result in at least an extra 10 million people over the next 20 years, a trend that is more than capable of overcoming any deflation as a consequence of a downsizing ageing population that ultimately has to imply persistently high real rates of inflation not just for house prices but for sectors right across the economy. Furthermore as more of the benefits for life claimants are increasingly encouraged or forced into work, in addition to many more retirees continuing to work in some capacity will improve Britain's productivity which coupled with ongoing exponential technological advances will mean that a ratio of workers to retirees that is unsustainable today could become sustainable 20 years from now which ultimately translates in workers being able to support a greater proportion of wages being spent on housing costs in terms of affordability than is the case to today, which is why those fixated on affordability ratio's as compared against those of the past will continuously find themselves wrong footed, as ratios get ramped ever higher from 20% of income 20 years ago to 1/3rd of income today to 50% of income in 10 or so years time. And finally another point to consider is that by far most of the increase in population will be made manifest in England, specifically as a wave rippling out of central London where the more distant the region the lesser the impact of population growth and therefore to more likely suffer the consequences of having an ageing population namely Scotland which is thus likely to continue to be subsidised at an even greater extent by England which means that whilst the SNP will continue to peddle there dreams of Independence via a second referendum, however the demographics imply it's going to become less likely of ever being achieved with each passing year! Which means whenever the SNP are speaking on the TV one should hit the mute button, or change channel rather than waste your time on listening to their fantasy. Therefore the message being painted by this demographics analysis supports my long standing view that one of the only ways for people to leverage themselves to the exponential inflation mega-trend is by being exposed to assets such as housing and not only that but whenever prices fall due to events such as the current BrExit chaos, and fluctuations in the business cycle, even if not in nominal terms but just in real terms (i.e. after inflation) than prospective home buyers should seize such golden opportunities because the over riding trend for house prices over the next 20 years will be Upwards! For instance I would not be surprised if house prices double over the next 10 years or so! So ALL of the risks are to the UPSIDE, i.e. if the Government loses control of inflation, which in its immediate aftermath would result in a real terms drop but which would sow the seeds for the next ramping higher of house prices just as the Great Recession house prices depression concluded in the embryonic bull market of 2012 soon followed with a bull market proper. In terms of implications for my forthcoming house prices forecast, then this analysis is supportive of my view for an overall bullish outlook for house prices for at least the next decade and likely beyond. Which means that there isn't going to be a crash or collapse as the Bank of England has recently been propagandising in attempts to scare the population and politicians into supporting Theresa May's BAD Brexit deal. For the reality is that any fall in prices over the next few months would be temporary as in terms of the big picture Brexit does not matter where house prices are concerned, deal or no deal, house prices are going UP in either case! In fact I would not be surprised if house prices soared soon after Brexit, i.e. do the OPPOSITE to the doom and gloom consensus view of the mainstream press. This analysis was first made available to Patrons who support my work - https://www.patreon.com/posts/uk-ageing-and-25361373 So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. Recent analysis includes:

And planned analysis for May includes:

Your Analyst wondering if the Night King is actually dead! Valar Morghulis Nadeem Walayat Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||