Dow Stock Market Trend Forecast and AI Investing Update (2/2) Dear Reader, This is part 2 of my July stock market trend forecast update.

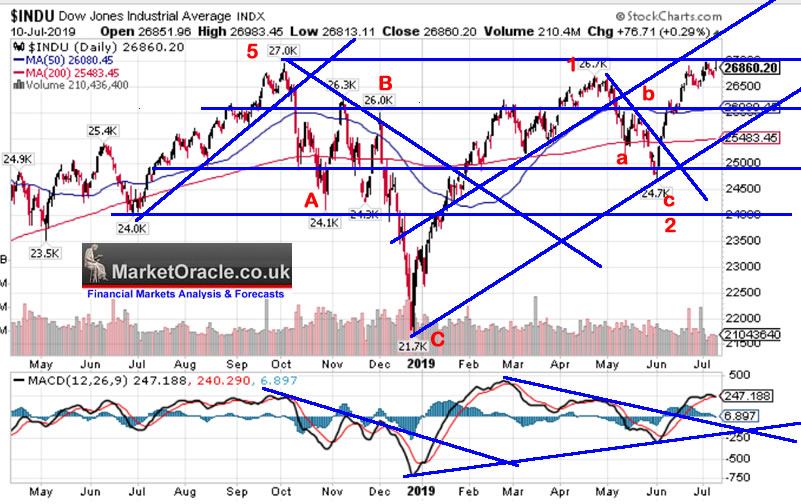

Much as expected the correction ended and resolved in a rally towards the trend forecast. With the Dow currently deviating from the trend forecast by about +1.5%. This analysis will now update the probability for the Dow continuing to oscillate around the trend forecast (red line) towards a September high of at least Dow 28k. Technical Analysis

Trend Analysis

Elliott Wave

MACD - Gave a strong bullish signal early June, that implied that the Dow could run higher for a couple more months before encountering resistance i.e. early August. Sell in May and Go Away - Seasonal pattern points to a continuation of the rally into the end of August.

Conclusion : Overall everything seems to be pointing towards a continuation of the stock market rally in line with my original trend forecast posted over 3 months ago! So I see no reason not to expect the Dow to continue to oscillate around forecast red line towards a target of at least Dow 28,000 by Mid September 2019. With the immediate trend expected to converge with the forecast i.e. a correction taking the Dow to the the forecast red line. Peering into the Mists of Time With the Fed now stating that it's going to CUT RATES whilst the DOW is trading AT new all time highs suggests to expect a more positive outlook for 2020 as the Fed is clearly seeking to reduce the risks of recession during election year and thus feed the stocks bull market, so I would not be surprised if this year we see a Santa rally to above Dow 30k on the back of Fed rate cuts! That's of course IF the Fed remains on track towards avoiding a 2020 recession! AI Stocks Investing And as I stated in the midst of the May correction, at the end of the day we are looking for opportunities to accumulate into the machine intelligence mega-trend stocks, especially those I consider primary AI stocks when they deviate significantly from the sector such as INTEL which is currently under performing at $48 after hitting a high of $59 in April.

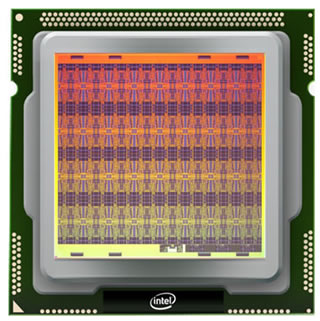

Whilst all tech eyes are on Intel's 10th generation of Intel Core processors code named Ice Lake to replace the i7 range. However, the real developments are taking place with their AI neural net processors such as Nervana to allow for a massive expansion in AI complexity.

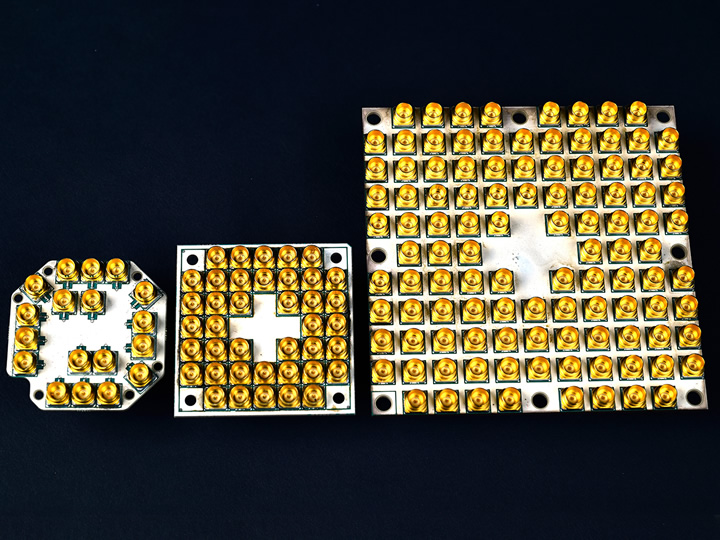

Intel Corporation’s self-learning neuromorphic research chip, code-named “Loihi.” (Credit: Intel Corporation) And beyond that are Quantum Computers with Intel's latest test chip being the 48-qubit Tangle Lake.

As part of the race to develop Quantum computers between Intel, IBM and Google. The 48-qubit test chip is potentially more powerful than any conventional micro processor. Intel has gone from a 7-qubit, to 17-qubit to now a 48-qubit chip over the past 3 years. Though the technology is likely still over a decade away from being practical, as it's yet to be figured out how to actually program them to fully utilise their immense potential processing power and we can only imagine the processing power that will come from systems comprising thousands of qubits. And remember that would just mark the BEGINNING much like being back in 1971 when Intel launched their first commercial microprocessor, the 4004! Qubits are the future! It's just that, that future is more than a decade away. EVERYTHING IS GOING TO CHANGE! Which is why INTEL, IBM and Google are Primary! NVIDIA - a higher risk tertiary stock is also showing a significant deviation in trend.

Whilst most of the rest have launched into space. For instance Facebook is up 20%, Microsoft 17%. Apple 12%.....

Remember investing is to accumulate now for the big pay off when AI changes EVERYTHING, because we are going EXPONENTIAL! This analysis was first been made available to Patrons who support my work. Dow Stock Market Trend Forecast July 2019 Update So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. Scheduled Analysis :

Your Analyst Nadeem Walayat Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||