Silver Investing Trend Analysis and Price Forecast 2019 Dear Reader, The Silver price reluctantly followed the Gold higher early in the year to a late February peak of $16.20, following which it abruptly gave up all of its hard won gains for the year by making a new low early March at $15, breaking the preceding low of $15.45 and thus entering into a downtrend of a series of lower highs and lows where it remained until the Gold price came alive at the end of May 2019. Following which the Silver price busted out of its 2019 downtrend by hitting a recent high of $15.15 before succumbing to selling to bring the price down to its last close of $14.74 DOWN 5% for the year which compares against the Gold price up 4% for the year which illustrates the persistent under performance of the Silver price against the Gold price.

This analysis was first made Patrons who support my work. Silver Investing Trend Analysis and Price Forecast 2019 So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. Firstly, my long standing approach to Silver has been one of buying (accumulating) when the Silver price is cheap to invest to capitalise on long-term Spikes, as the silver price patterns don't tend to prove very reliable in terms technical analysis i.e. prone to a lot of false signals so Silver is a difficult market to trade that only tends to really come alive towards the end of precious metals bull markets as illustrated by my analysis of May 2018 - Silver Forecast 2018 and Beyond, Investing for the $35+ Price Spike! In terms of a Silver market position then as is currently the case the silver market can usually be expected to be a dead market with the tendency to flat line not just for many months but even years as it tends to play second fiddle to Gold in terms of tradable swings, usually only really coming alive towards the latter stages of precious metal bull markets. With the trend analysis in the accompanying video: My last in-depth analysis of 19th December 2018 Silver Price Trend Analysis and Forecast 2019 concluded in expectations for a volatile trend towards a spike high of $21 during 2019.

(Charts courtesy of stockcharts.com) Silver Price Forecast Conclusion Therefore my forecast conclusion is for the Silver price to trade in a volatile trading range with an upward bias towards a target of $21 later in 2019 which would represent a 42% gain on it's current price of $14.70. Whilst the spike to at least $35 remains as a longer term outlook. Whilst my most recent analysis of Gold (30th of May) concluded in expectations for the Gold price to attempt to break above resistance of between $1350 to $1370 by September 2019, which at the time was trading at $1286. Gold Price Trend Forecast Summer 2019 Gold Price Forecast Conclusion Therefore my forecast conclusion for the Gold price is to trend higher towards a target of $1350-$1370 by late September 2019. This trend can be further broken down to expect a minor correction during July off of a June peak with the rally resuming during August and September.

Soon after the Gold price has busted through $1300 and hit resistance at $1350 currently retracing down to its last close of $1331, with the breakout igniting fire under the precious metals sector helping to drag the Silver price out of its downtrend over the past couple of weeks.

Silver Long-Term Trend Analysis

What stands out from the long-term chart is that Silver tends to be pretty much dead for most of the time, only really coming alive towards the later stages of precious metals bull market manias when everyone begins piling in just before the bubble pops! Which is a warning not to get carried away with fantasy targets for Silver but try and keep things real by focusing on what silver has done in the past, namely the Silver price cap is $50. I could try and hunt for fundamental reasons why Silver tends to spike from time to time but it's really just speculative interest i.e. a buying mania. With all of the reasons often put forward such as a weak dollar not stacking up to close scrutiny, for yes a falling dollar is bullish for Silver, but not to the extent that many gold and silver bugs imagine it to be as the long-term dollar chart illustrates little correlation against the Silver long-term chart.

Presently Silver is stuck in a multi-year trading range of between $13.50 and $21, pending a mania driven spike higher. The downtrend off of a high of $21.23 was targeting a trend towards support of $13-$14, that a decline to $13.86 achieved during 2018. However there is no sign on the long-term chart that the Silver price is going to come alive any time soon i.e. it could continue to trade in a tight trading range of $18.50 to $13 for some years. On the brightside the downside is limited to around $13, with greater upside potential of a trend to $18 and then $21 a breakout of which would target a spike to at least $35 and if your nimble you could cash out on the way towards $50. Whilst the longer the silver price spends trading at low price levels then less investment in new supply (mining) thus sows the seeds for a future mania driven price spike. Silver Medium-Term Trend Analysis

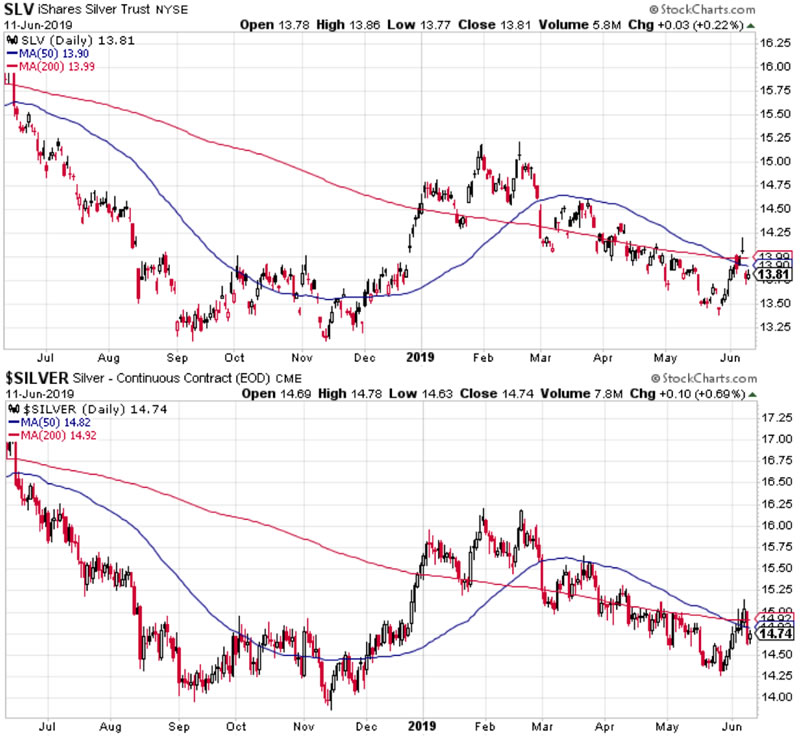

The medium-term chart shows early signs of Silver changing trend by attempting to end it's multi-year downtrend by making a higher high of $16.20 and higher low of $14,27. A break above $16.20 would lift Silver into a new trading range of $18 and $16.20. Which if it happens will mean we won't revisit the $14.00 area for some time. So with Silver currently trading at $14.74 then time may be running out to accumulate Silver at a sub $15 price. Silver Short-Term Trend Analysis The short-term chart shows an accumulation zone of between $14 and $15, with upper trading zones of $15 to £16.30 and then $16.30 to $17.50. Thus a breakout above $15 would target $16 and then $17.50. Whilst the downside is limited to about $14.

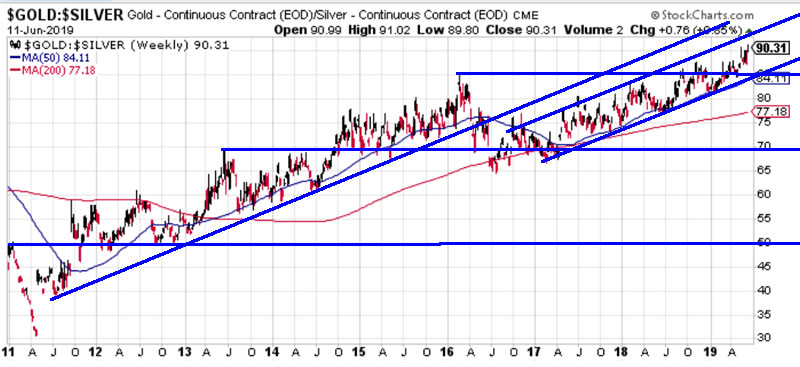

MACD - The MACD is neutral so supportive of another run higher to $16.25. Gold - Silver Ratio The Gold-Silver ratio is trading at an historic extreme of 90.31, at a level not seen for over 25 years. In comparison the historic average is 50 which on the current Gold price of $1330 would have the Silver price trading at $26.60. Which just goes to show how much of a coiled spring Silver tends to be as it eventually tends to swing sharply in the other direction at mania peaks.

The ratio chart shows heavy support at around 70 which equates to a Silver price of $19 thus an achievable target for Silver in terms of its valuation against the Gold price on successful achievement of which Silver could target a ratio of 50 ($26.60). So the Gold - Silver ratio is bullish for Silver suggesting that the Silver price 'should' at least target $19 during 2019. Formulating a Trend Forecast The long-term picture is of the Silver price being stuck in a trading range of between $21 and $14 pending a breakout higher with the current resistance at $15.25. Then resistance at $16,25, $18.50 and finally $21. The silver price only really tends to come alive during a monetary crisis of sorts be it financial or inflation, stock market panic etc. So is there a crisis on the horizon? Well whilst Trump's china trade war is stressing the system a bit, it's not exactly reached the point yet where each side is threatening military action and trade embargo's so we are not quite there yet. Whilst many may argue that another financial crisis is brewing out there, perhaps in student and auto loans. But again we are not quite there yet hence Silver remaining in hibernation. Whilst the US economy may be slowing, it's not exactly teetering on the brink of recession yet. So where Silver is concerned, the technical's, fundamentals and inter markets are saying were not quite there yet in terms of that Spike higher. So whilst Silver may reluctantly follow the Gold price higher, I am not seeing it blasting off past resistance of $21 anytime soon. Silver Price Trend Forecast Conclusion Therefore my forecast conclusion is for the Silver price to continue to trade in a volatile trading range with an upward bias towards a target of $18.50 later in 2019 as it steps higher into each successive trading range i.e. $15.25 to $16.25, then $16.25 to $17.30, then $17.30 to $18.50, which would represent a 25% gain on it's current price of $14.74. Whilst a spike to at $35+ remains a longer term objective. Remember Silver is for Long-term INVESTING rather than to try and trade because it is a volatile messy market in terms of TA. Where the key accumulation zone for the past 5 years has been $14 to $15 which is where we find the Silver price currently trading. The bottom line is that I see Silver as a coiled spring because in historic terms it is very undervalued against Gold and so I expect that spring to eventually propel Silver into an overbought state against Gold even though we are likely several years away from when that happens. How to Invest in Silver The easiest way to gain exposure to Silver is via the SLV ETF. Though remember you are investing in a trust so the SLV trading price will not be the same as the Silver market price, but the SLV price trend usually does quite closely track the Silver price trend as the following chart illustrates:

Disclaimer - I am invested in Silver (SLV) This analysis was first made Patrons who support my work. Silver Investing Trend Analysis and Price Forecast 2019 So for First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat. Scheduled Analysis :

Your analyst Nadeem Walayat Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | ||||||||||||||