| What’s the right philosophy for running the modern world and its economies? This is the epitome of almost all political and economic questions we ever ask and debate, and yet we know it’s unlikely we’ll ever find the perfect answer. One of the most consistently controversial points within the systems in place now has been short-termism, this idea that the supposedly short-sighted, profit-driven nature of businesses has potentially negative ramifications on individuals and the world at large. So is it valid or nah? Although it might not be trending like interest rates, inflation, and war, short-termism has always been a backdrop of sorts to almost all ongoing events in the market, and has become even more debated recently. Are the fears around it valid though? - The complaint that short-termism subtly nudges businesses to invest less into long-term ventures, research and development is a big one, with the overarching idea being that near-term profits matter more to executives. The data shows otherwise though, because R&D expenditures in the private sector as a share of GDP reached new highs in 2020.

- What about buybacks? In some instances, engaging in share buybacks can definitely be questionable for businesses that can’t afford it, potentially hurting employees and the company’s long-term potential for growth. In reality though, many noteworthy buybacks are done by businesses who are swimming in cash at times when interest rates are low, and allocating a little to their shareholders usually doesn’t hurt.

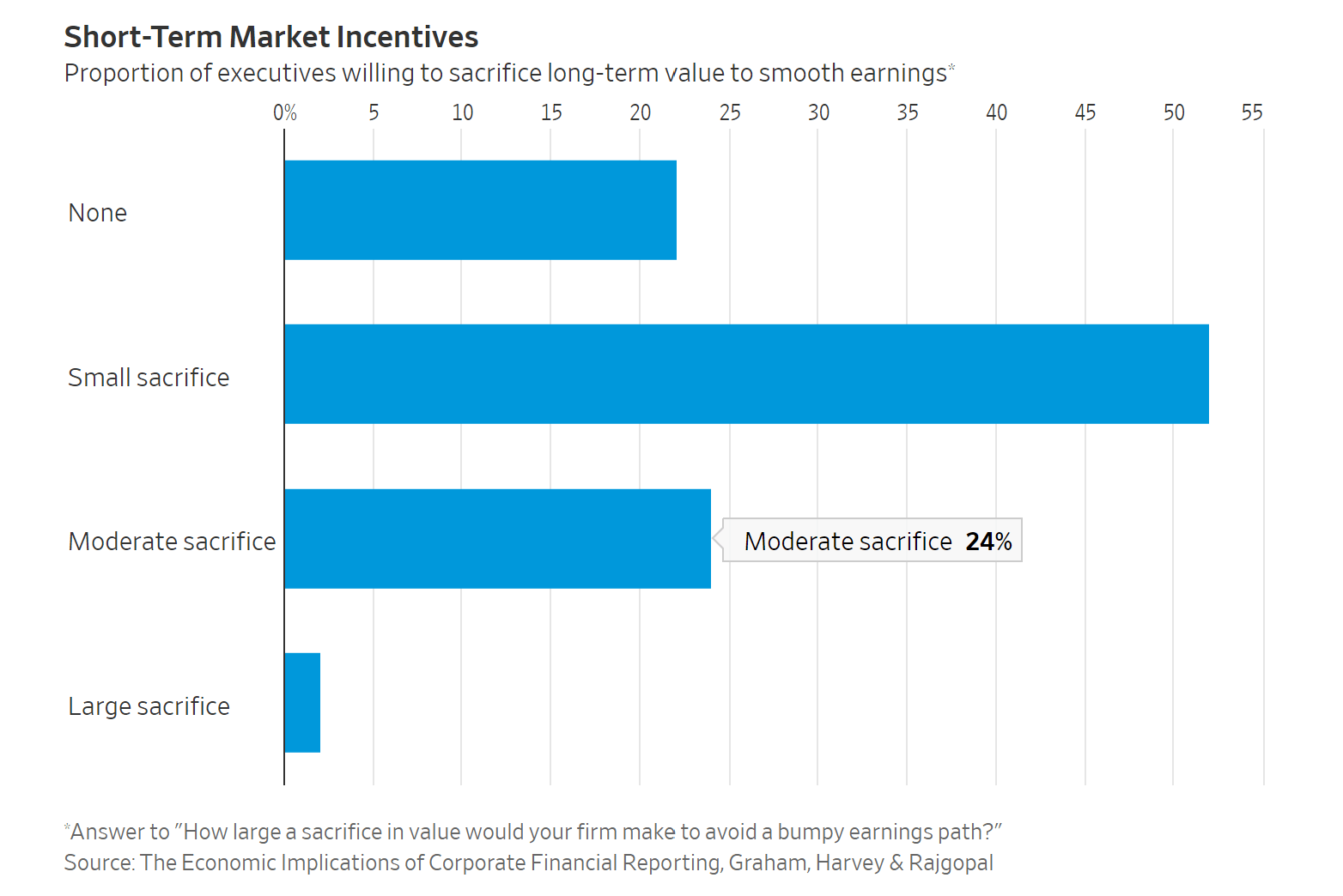

- As for executives' opinions, they might be the worst looking data point on the matter. A very popular study did find that about 78% of executives were willing to take on longer-term costs or give up economic value just to maintain earnings in the short run. This is especially true when executives have to make hasty and chaotic decisions to live up to their quarterly predictions. All-in-all, this is the most contentious point.

Zooming out: Although short-termism naysayers have compelling arguments, the WSJ reported that after going through 60 additional research studies on the topic, the implications of short-termism amount to nothing more than a small problem for companies. |