TOGETHER WITH  | Good day to you. Can you guess how much the average US credit card holder had in credit card debt in Q4 2021? a. $2,900, b. $5,900, b. $8,900. Follow the 🌊 below for the answer. Here are the money topics we cover today: - The market is changing investor behavior

- Trouble for stablecoins

- Everyday debt levels rise

| |

INVESTING The Market Is Changing Investor Behavior | | | | When you’re new to something, a great way to learn is through experience. Well, the markets have seen a gluttonous amount of new investors flood into them over the last couple of years, and 2022 is proving to be the first learning curve for many. As we’ve exited the goldilocks zone of stimulus and easy money, the tide has begun to pull back and reveal the realities of our present economic situation. All of this fear has shaken the lofty markets into a bear cave, and it’s forcing investors to adjust. How far we’ve fallen We’ve covered the market’s fall from grace multiple times this year, and each time the losses have gotten bigger. We just saw our biggest single-day drop since the pandemic panic, and it’s becoming normal to watch any given index whipsaw by multiple percent a day. - Basics: The S&P 500 is down over 16% YTD, the Dow is down 12%, with the Nasdaq and the Russell small-cap down 25% and 22% respectively.

- Ari-stock-racy: As of May 5th, just 35% of stocks within the S&P 500 were north of their 200-day moving average. The Nasdaq is even worse, with only 20% of holdings hanging on for dear life. This is a pretty clear indication that the big names are mostly the only equities left with any say, while the rest have left thousands of investors "holding the bag," if you will.

- Back to normal? The S&P 500 has a decade-long average of trading at 17.1x its projected forward earnings, and even after this drawdown, it’s still sitting above that number of around 17.7—right back to where we were before 2020's euphoria kicked in. It makes you wonder, maybe this haircut is warranted after all?

Investors forced to reconvene Market activity in aggregate has seen a noticeable run-up over the course of the last two years, and this frenzy has bled over into a lot of things—from unhinged numbers around options and crypto to heightened trading volumes. Now, that’s changed though. - Less activity: Fear is keeping a lot of investors on the sidelines for now. Even without any hard numbers on it, it’s clear to see that volume is down in a variety of areas, especially in more speculative plays. Coinbase just reported having lost 2 million monthly users since Q4 of 2021, and we already know the NFT slump is here. Besides, what happened to a new meme stock clocking 100 mill in volume every day?

- Optionless: Overall volume recorded for call options on individual equities has reached levels not seen since the end of 2019, signaling that overall bullishness could be reaching a near-term low, and that fear is setting in for many.

- Bad vibes all around: The number of investors holding a bearish sentiment toward the markets is at its highest point since 2009, which is pretty ominous to say the least. At over 52%, we’re seeing numbers that we didn’t even reach in 2020.

(Source: WSJ) | | | |

CRYTPO Trouble For Stablecoins |  | | Terra's (LUNA) | | | Stablecoins are meant to be a bridge between traditional and decentralized finance (DeFi). It's supposed to allow users of these coins to hold similar (if not same) value alongside the dollar—or whatever it’s backed by—and reap the defi benefits without the normal risk of volatility of a typical crypto coin. In the midst of all the crypto volatility last week though, one of the niche’s largest stablecoins, TerraUSD, suffered what’s known as being de-pegged or losing its link to the dollar, raising some concerns about projects like it. Why it happened - Basics. TerraUSD (UST) is a stablecoin governed algorithmically by a protocol on the Terra blockchain. It maintains a peg to the USD thanks to incentives around Terra (LUNA), the Terra blockchain’s native cryptocurrency. In other words, UST is an "algorithmic" stablecoin because it relies on a complex set of code, and coupled with a floating token called LUNA, it all works together to balance supply and demand and stabilize the price. Fiat-backed stablecoins like tether and USDC, hold fiat assets in a reserve to back their tokens and keep prices stable.

- Mechanics: UST would always be redeemable for 1 USD’s worth of LUNA even if its value dips below 1 USD. So, even if UST falls to 0.95 USD, you can quickly buy lots of it at a discount and redeem each UST for 1 USD’s worth of LUNA, turning a profit through arbitrage. In other words, if LUNA traded at 50 USD, each UST you bought for less than 1 USD would give you 1/50th of a LUNA, equivalent to 1 USD. The stablecoin is kind of like a smart thermostat, it balances itself around its target value of 1 USD through incentives.

- Decoupling: With a lot of fear going around coupled with crypto’s recent woes and even rumors of an attack on UST, things eventually piled up, leading to $5 billion worth of UST coin being withdrawn from the Anchor protocol, which is a DeFi app that runs on the Terra blockchain. LUNA has since become worthless, and UST is now worth around 9 cents relative to its $1 goal.

Why the worry - Stablecoin trust: A debacle of this magnitude with that much deviance from par value is a big deal to many, and will understandably make some wary of stablecoins. It also raises concerns as to whether or not we’ll be able to see a longstanding algorithmic coin too, as this event has unearthed new vulnerabilities in that methodology. Other types of stablecoins include fiat-backed, and crypto-backed which use reserves as collateral.

- Pending regulations: Crypto regulation is already looming, and breakdowns like this are likely to add a little fuel to that fire. There are a lot of propositions floating around specific to these coins, ranging from new insurance requirements to interoperability and regulating them similarly to bank accounts. Crypto optimists maintain that such attacks make the ecosystem stronger and that regulation will drive further adoption.

🪙 Want to review the core fundamentals of stablecoins? Take this bite-sized lesson on the topic: | | | |

SPONSORED BY JOT Barista-quality coffee in seconds | | | | Jot is coffee – made easy. With just one tablespoon of Ultra Coffee concentrate added to water or milk, you’ll have barista-quality coffee in seconds. What makes Jot Ultra Coffee different from traditional coffee? - At 20x the concentration of regular coffee, Jot Ultra Coffee delivers an unmatched level of convenience, clarity of flavor, and range of versatility.

- Each 200ml bottle makes fourteen 10oz cups of coffee, which will cut your cost for a cup of coffee down to just $1.39.

- Jot Ultra Coffee is made solely from organic beans sourced ethically from farms in premier coffee-growing regions.

Jot has already made a big splash in the coffee industry with over 12,500 five-star reviews and resignation as one of Fast Company’s Most Innovative Companies of 2022. Try Jot’s Ultra Coffee today and get a free welcome gift with your order. | | | |

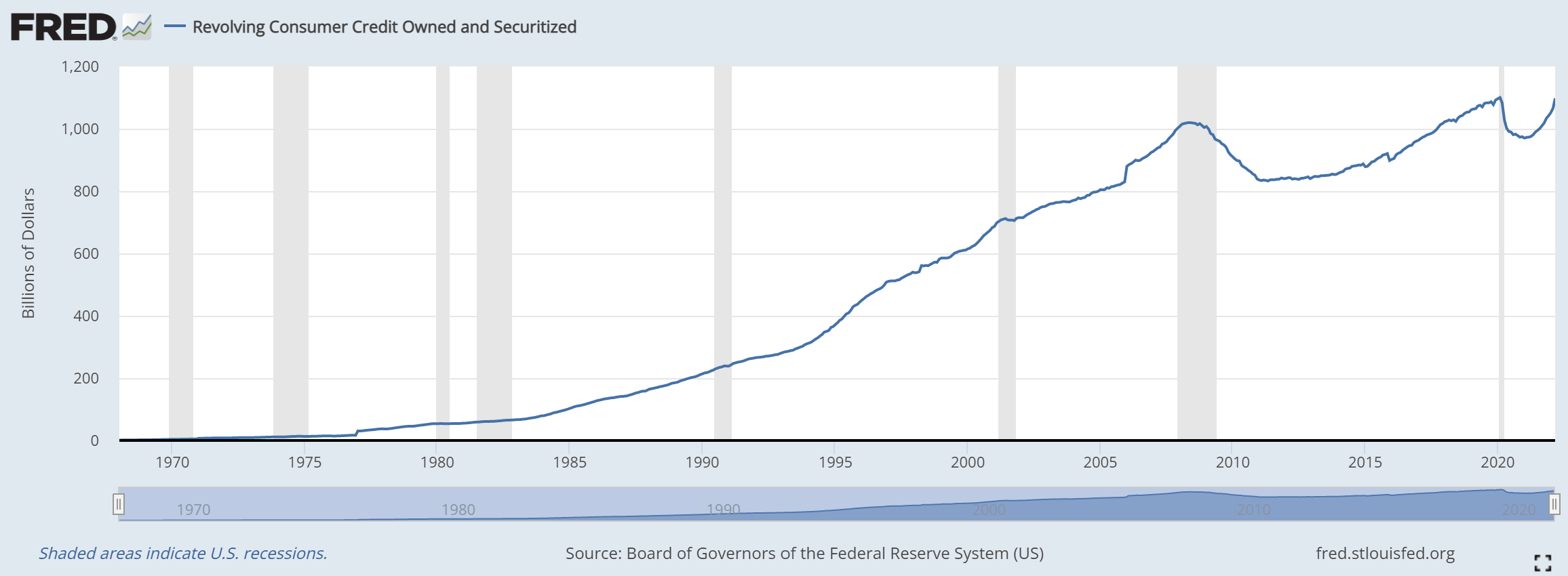

PERSONAL FINANCE Everyday Debt Levels Rise | | | | Americans racked up $31.4 billion dollars worth of revolving debt in March of this year. That’s an annualized growth rate of about 35% and the largest such spike in that category since 2006. Wait, what's revolving debt again? Simply put, it refers to money you owe on an account that allows you to borrow against a credit line—a credit card is a prime example. And we now have just about $1.1 trillion dollars of revolving debt owed, bringing us just shy of where we were prior to the onset of the pandemic in 2020. That’s a lot of swiping and online shopping.

What could we take away from this trend? - Be prepared for higher prices: Although hard to say for sure, it’s entirely plausible that much of this debt has been accrued due to the rising prices and increased inflation we’ve seen over the last year. If we’re not prepared to leave extra room in our budgets for increased costs, it’s easy to accidentally find ourselves in a situation where a loan is needed to make ends meet.

- Don’t let a raise get to you: Wages and salaries grew by 5% in the private sector during Q1, and this is just one anecdotal data point that exemplifies how higher compensation is being demanded due to the higher cost of living. Sometimes though, a raise can actually make us poorer when we’re made to feel too wealthy by it, leading some of us feel a little too comfortable taking on more debt. This is a critical mindset trap to avoid, because it can turn progress into regression.

🔗 Related lesson on this topic: | | | |

🔥 CORPORATE CORNER Today's Movers & Shakers | - Walmart (-9.8%) as they missed the street's earnings expectations due to inflationary pressures, supply chain issues, higher inventory and over-staffing; its sales outlook is positive but future guidance on profits was lowered

- Paramount Global (+14.1%)—owner of CBS, MTV, Nickelodeon, Comedy Central and Showtime—as Warren Buffett’s Berkshire Hathaway acquires a $2.6 billion stake in the entertainment conglomerate

- United Airlines (+6.3%) as it raised its current-quarter revenue forecast; the company expects its busiest summer since before the pandemic

- Bitcoin (-3.71%) to $30,101.98 over the last 7 days

- Ethereum (-11.9%) to $2,060.52 over the last 7 days

This commentary is as of 8:45 am PDT. | | | |

🌊 BY THE WAY | - Answer: It's $5,934 to be exact. Individuals 75 or older had the most average credit card debt ($8,100), and those under 35 had the least ($3,700) (Money Geek)

- 🍔 ICYMI. Beware of lifestyle creep. It may be sabotaging your savings (Finny)

- 💾 You can now ask Google to remove your personal data from its search results—here’s how (CNBC)

- 💊 Final days to get in on this $480B market disruptor. Generating $32M+ in annualized revenue in 2022, NowRx is offering investors a stake in their tech-powered pharmacy that offers free, same-day prescription delivery. Learn more about investing in NowRx before their round closes this Friday night at midnight PST.

- Finny lesson of the day. With credit card and revolving debt on the rise, it's worth also covering the good, the bad and the ugly when it comes to personal loans:

| | | |

|

What did you think of Finny's The Gist today? (Click to vote) | | | |

| Finny is a financial education platform on a mission to make your money work for you. We offer a customized financial learning platform through bite-size, jargon-free lessons, money trends & insights to teams & companies. The Gist is Finny's twice a week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. Finny does not offer investment and stock advice or endorsements. The Gist content team: Austin Payne, Othmane Zizi, Chihee Kim. We're thankful for our sponsor—Jot, NowRx— and for their support as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |