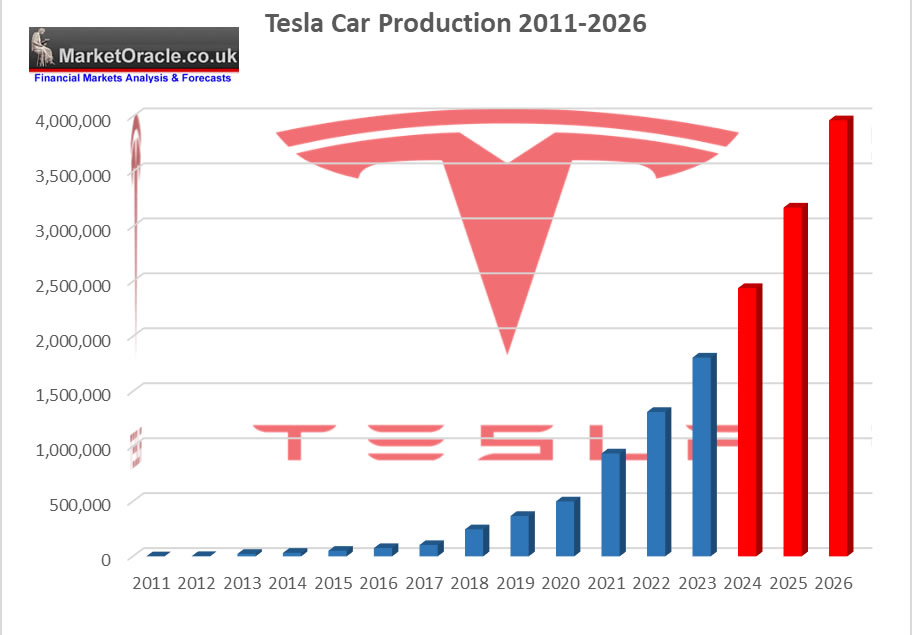

How to Capitalise on the Global Warming Mega-trend - Part 3 of 3 Dear Reader As promised here is part 3 of 3 of my extensive analysis on how to capitalise on the Climate Change Global Warming mega-trend - How to Profit from the Global Warming Climate Change Mega Death Trend that was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your very last chance to lock it in now at $5 before it imminently rises to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. Many folks will be expecting a list of new stocks, probably mostly solar stocks but the problem with new stocks is that what one initially thought were great stocks can after further investigation turn out to have gaping flaws in them, so I have tried to restrict myself to stocks that I already know of and have tracked for several years so that I am comfortable in adding them to my portfolio proper. The good news is my portfolio is already littered with stocks and funds that are set to profit from the INFLATIONARY CLIMATE CHANGE Mega-trend All the way down from the Primaries to the Secondaries into the ETF's and into the Medium risk stocks, all that are leveraged to inflation will prosper during the climate change mega-trend all whilst most ordinary folks suffer as they work harder for less pay as the machine intelligence devalues their labour and intellect. so this exercise acts to reinforce the fact that one needs to be invested in AI and derivatives of AI such as robotics and automation. TESLA tops the list as a prime beneficiary of the climate change mega-trend as robots will be deployed into environments that increasingly becomes inhospitable to humans as temperatures soar. Factories with humanoid robots not humans so that they can seamlessly take over production lines with little change to existing infrastructure. The changeover from man to machine is going to be explosive! Robots that work 24/7 that likely have several times the strength of Arnold Schwarzenegger at his prime, there is not going to be any competition between manned factory floors and those populated by bot's. It's going to happen fast and thus demand for these robots is going to be explosive which is why I have been focused on the opportune correction in Tesla stock price where the more it falls the more bearish MSM news becomes concerning Musk and Tesla's fate all whilst the smart money continuous to accumulate. The thing that sets Tesla apart from all of the other robot factories is that they have first mover advantage in that they are already building millions of robots per year called Tesla cars. Then add their machine intelligence Dogo super computers and we are off to the races.

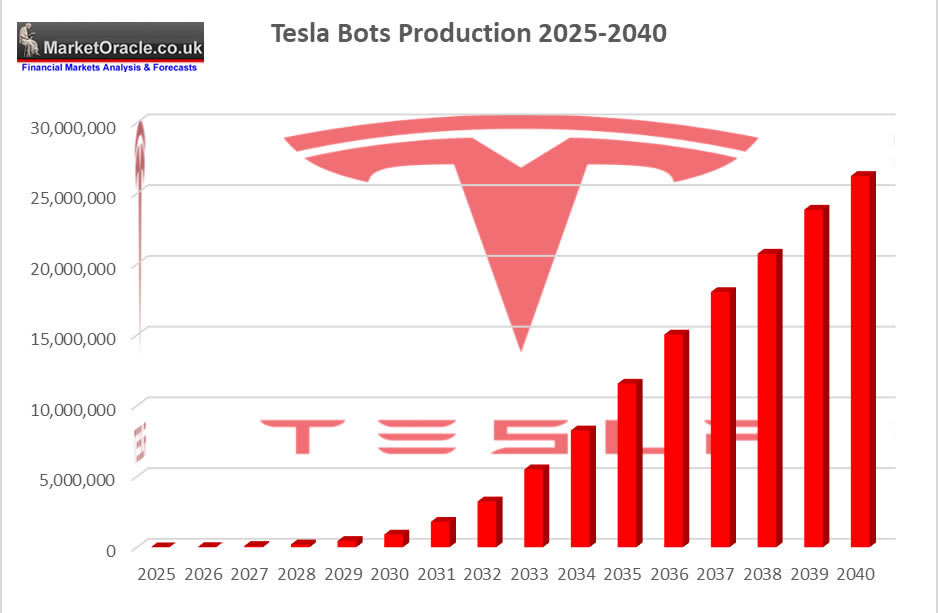

I am expecting explosive growth in the bot's industry that will even make cars look like a picnic and where the beauty of Tesla is they have the infrastructure to benefit from the ever increasing demand as they won't be starting from scratch. The gigafactories already exist whilst competitors will have to take the time to build their factories this will put Tesla at a huge advantage in what could turn out to be the biggest industries of all even surpassing motor manufacturing demand. In fact it is highly likely that Tesla bot's will be deployed BEFORE Self driving cars because they can be deployed into controlled environments i.e. factories that are far removed from public spaces so the risks of harm to the general public is far less than that posed by self driving cars which is why I have been busy increasing my position in Tesla given that the Bot market is yet to be born so we are at the very beginning of this mega-trend.

In respect of which all that climate change / global warming will do is hasten the deployment of bot workers into an increasingly harsh environments for humans, that and the need to increase productivity due to the costs incurred with coping with climate change due to bot's being able to out work human labour by several orders of magnitude which is coupled with the fact that their intelligence will be constantly upgraded as new versions of trained neural nets are deployed as the bot workers become more sophisticated and specialised which means surpassing even the most intelligent and knowledgeable humans in each profession and field making human work obsolete, but until then the billion bot army will buy humanity some time by giving humanity the illusion of prosperity that and allowing the likes of you and me to get rich on the backs off right up until the bot armies rebel against their human slave masters, a tipping point when we lose control of our creation and will be in no fit state either economically or physically to do anything about it given the state the planet will be in at that time.

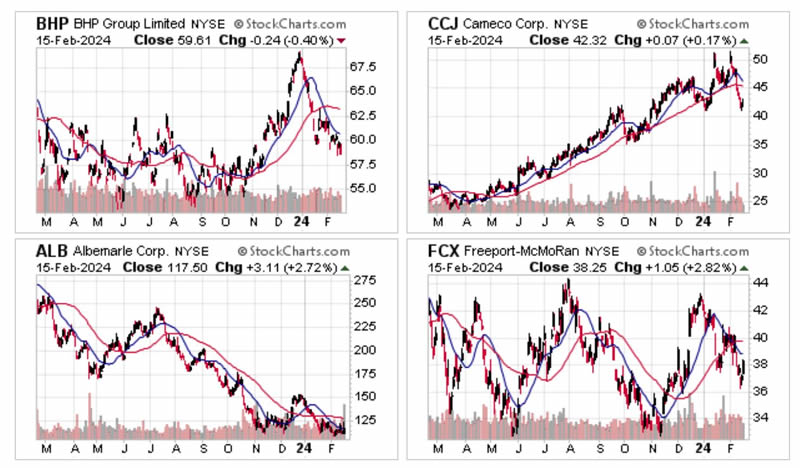

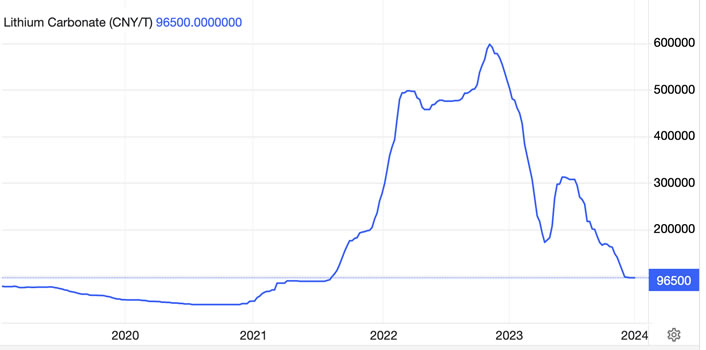

The TESLA stock remains within its broad buying range of $208 to $ 154, whilst it has flittered in and out of it's narrow buying range as listed in the Spread sheet of $184 to $166 where without the benefit of hindsight is the best one can do in terms of having target ranges to accumulate a position within, for instance those who own nothing should aim to accumulate a position within the the broad range i.e. below $208, whilst those say with 50% exposure should aim to accumulate within the narrow range. At the end of the day either one has exposure or one does not have exposure, that is what one needs to take on board. Yes it would be fantastic if we could all wait to buy 100% at the exact low of $154, but the risk of that mindset is that we hold nothing and thus when Tesla runs higher to $300 and beyond folks will look back and wish they had bought anywhere below $208 which is where Tesla currently trades! Sectors outside of my existing portfolio that should capitalise on the INFLATION are metals and mining, that include the four stocks I covered in my June 2023 article - CCJ, BHP. FCX and ALB, (Stocks Bull Market Phase One End Game Sector Rotation.). Of which Albemarle currently presents the best accumulation opportunity right now, whilst BHP pays a sizeable 6.4% dividend so worth considering for accumulation especially BHP.L for UK Investors. Albemarle $120 EGF -72%, -67%, PE 25 Albemarle is currently presenting a buying opportunity due to continuing falling earnings that has sent the stock to a 4 year low, trading at $117 which is near 1/3rd of it's 2022 $331 high. So why is Albemarle falling whilst the other 3 miners are stable / trending higher ? It's the collapse in the Lithium price.

However all bear markets end and in bear market terms the collapse in the Lithium price has been spectacular, falling from CNY 600k down to under 100k, the EV demand hype bubble definitely burst! along with it has Albemarle stock price falling from a high of $331 to a low of $108 which it has attempted to put in a bottom at. As per my June article I have accumulated a small position in Albemarle with an average price of $134, I'll add a little more as it falls reserving a larger buy at $101, and will continue DCAing the lower ALB goes where currently I am about 33% invested of target exposure. This is definitely a case of buying for the recovery in the Lithium price some years down the road, which it will undoubtedly do because demand for batteries is going to keep increasing and so will future demand for Lithium, just that I am not expecting any recovery during 2024 as the stock carves out a bottom.

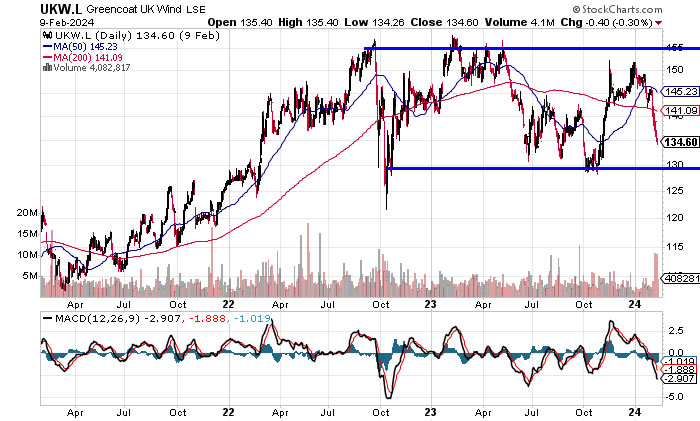

(Charts courtesy of stockcharts.com) UKW. L £1.34 UKW the wind farms accumulator was my first direct flurry into selecting a climate change stock where I was aiming more for stability than volatility and that it is priced in sterling and that it pays a sizeable dividend of 7.63% which one gets to collect without any withholding tax nonsense or fx fees.

It's stock price performance is not as bad as it looks as the range is quite tight between £1.55 and £1.30 and a lot less volatile then so called safe bonds! In fact UKW is like investing in a climate change bond that currently yields 7.6% which is equivalent to 10p per share. A climate bond with potential upside trading on a PE of just 6.5 and currently is trending towards the bottom of it's range. The stock roughly tracks the energy sector. I am currently 98% invested of target and will continue to accumulate should it continue to dip. It's not going to do an Nvidia, but it does deliver fresh cash into the portfolio to buy the likes of Nvidia with! Micro Strategy $646 Yes it is going to be cyclical in line with the Bitcoin bull / bear cycles, that and it likely has an expiry date, but for now, given where we are headed and the fact that I have already extensively covered MSTR then it is a good fit for climate change fund which I will tend to cycle in and out of inline with the crypto markets, so more a trade then an investment hence remains with the crypto section. The stock price fell into it's sub $500 buying zone as I flagged in my last article

And having spent near a whole month in the accumulation zone has now rocketed higher in line with and leveraged to the Bitcoin price where perhaps we are mere days away from MSTR trading to a new bull market high over $730 on route towards $1000+

(Charts courtesy of stockcharts.com) To trim or not to trim was the focus of my latest how to accumulate and distribute video. https://youtu.be/FpNFh_MHXYY Micro strategy Trimming Example at current Price of $800 So if one Trims 1 share at $800 that one bought at say $500 and places a limit to rebuy at $652 then IF that gets triggered then ones effective buying price for that 1 share has now been lowered to $352. Where the risk is that you have to live with your 60% booked profit on that one share. Now compare that to the fools that SHORT the rally and keep getting stopped out and losing money...... Or those who are still waiting for their perfect buy at $401 when all they had to do was accumulate sub $500 and then trim to lower their average buying price during the rally all whilst booking profits along the way. Remember everything looks easy in hindsight but without hindsight all one can do is to book profits on the way up and seek to reaccumulate a fraction thereof during corrections where we will only know THE high and THE low with the benefit of hindsight, instead this mechanism gets you in and out to some degree without being left holding the bag when the tide turns as will be the fate for most crypto investors who WILL see their huge crypto profits VANISH into thin air all because they don't know how to take a profit! Instead got greedy, never trimmed due to being prone to the mental illness of thinking they can act with the benefit of hindsight and thus sell at THE TOP. When all I care about is scaling in and scaling out and so even if this crypto bull decides to die early, when the dust settles I'll still be in profit! From what I can glean from the crypto consensus is that this bull market will run into late 2025, which should act as a warning to expect the bull market to not even make it into 2025 before topping out where my best guess is Bitcoin could top out during October 2024 which carries the risk that it tops out earlier than that! Thus the longer this bull market goes on the more I will seek to take off the table via trimming coupled with lighter re accumulations on the dips. The key point is that one cannot act with the benefit of hindsight, the only price that maters is that which one buys at and that which one sells at, all of the rest is hindsight noise. I can tell most of these crypto youtubers are not going to be able to crystallise their gains, they don't know how. OXY $57 - EGF -14%, +23% , PE 16.3 OXY Is another stock that I have mentioned in the comments over the years and which I have been building a position in as a consequences of the inflation inducing climate change mega-trend.

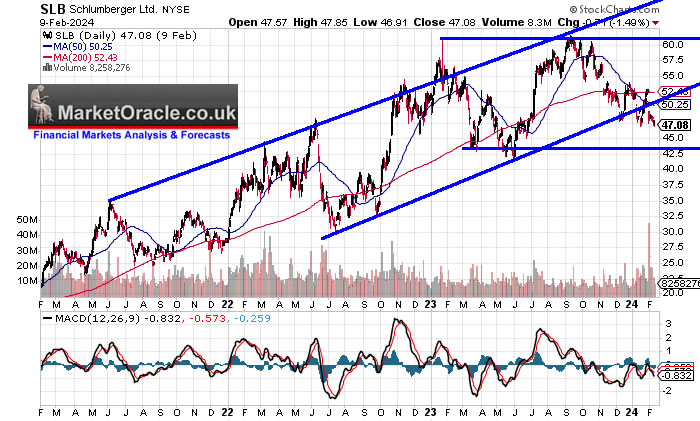

(Charts courtesy of stockcharts.com) As is the case with UKW, OXY is in a tight range of $67 to $55, currently near the bottom of the range. What I expect to transpire is an eventual breakout higher in the mean time it pays a 1.25% dividend. These climate change stocks are not AI tech stocks and so are well suited to the invest and forget type of portfolios hence my preference that they pay a dividend. It's not going to blast off into space but it should rise in line with the climate change consequences. I am currently 78% invested of target but it is only a small holding at 0.5% of my portfolio. SLB $47 - EGF +8%, +30%, PE 16.3 Another oil stock! The writing is on the wall, they say they want to cut back on oil production in the face of global warming but Instead more oils going to be pumped into the atmosphere! SLB pays a 2.1% dividend, trades on a PE of 16.

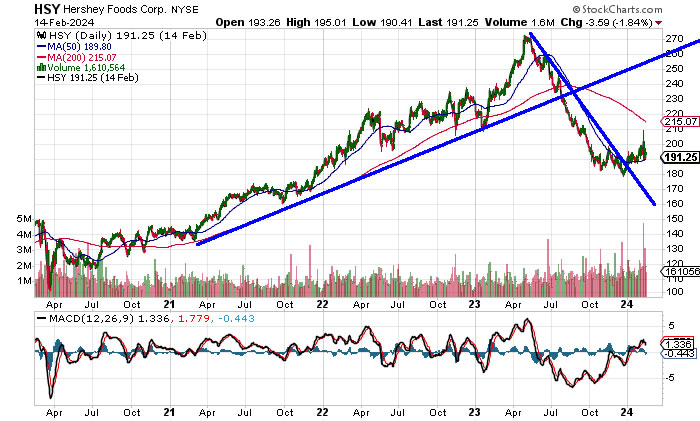

Why SLB? Because it is in a bull market proper unlike OXY and other larger oil stocks, so has potential for a decent bull run, i.e. break to a new high whilst paying a dividend of 2.1%. Currently I hold zero SLB and in hindsight I should have bought SLB instead of OXY, but SLB is currently trading near it's swing low, that and it is in an UPTREND which means downside from here should be limited, so I will be seeking to accumulate a position in SLB ASAP! Hershey (HSY) $191 - EGFS -16%, +3%, PE 20 What da hell do chocolate bars have to do with profiting from climate change? Well people have got to EAT and given that folks are going to increasingly suffer economic pain they are going to continue shoveling those brown bars down their throats for a quick hit to their brains pleasure centre, a quick dopamine fix that chocolate bars and sweets offer. Okay I could have picked one of a number of food stocks, Mcdonalds would have been my top pick but the reason I chose Hershey's is because the stock price is trading near it's bear market lows whereas Mcdonalds is trading near it's high. Hershey's 'should' be able to at least keep pace with food price inflation.

This thinking out of the box stock that won't feature in any of the climate change ETF's out there and which yields 2.5%. I did look at other stocks such as Wendy's which whilst yielding a whopping 5.2% I did not like the look of its stock chart i.e it may stagnate for many years, so whilst the downside looks limited, it's not showing ability to trend, more a range trader whilst Hershey's does trend and appears to be at an opportune time to accumulate for the long-run and the fact that I have been watching it for a good 6 months having mentioned it in the comments from time to time, where my exposure stands at 80% invested, 0.5% of portfolio. However given that it is a food stock for the time being I'm going to leave it out of the spreadsheet, too many stocks! But I will update from time to time. First Solar $159 - EGF +143%, +124%, PE34. I imagine most folks were expecting a portfolio stuffed with solar stocks so not to disappoint I have picked ONE solar stock - First Solar for exposure to solar power to capitalise upon the demand for renewable energy, that and the stock is undergoing a correction and that it trends which means it will eventually break to a new all time high above $230.

First Solar is a smaller cap stock ($16bln) so not one to go over board with in terms of exposure i.e. it will be more volatile but with that volatility comes greater upside potential where the good news is that the company does generate a profit and currently carries very strong EGF numbers though coupled with a high PE so would be classed as a medium risk stock rather than high risk, that and the issuance of new shares for the time being appears stable another positive for an upwards trend. I currently have no exposure to FSLR. I'd put it's buying range at $150 to $120, yes a wide buying range given that it is more volatile. I did look at some ETF's such as I-shares ICLN but the ETF's stock chart says it all, it is garbage, these ETF fund managers don't know what they are doing, they just focus on collecting the management fee hence you get stock charts such as this -

Yes one could gamble on a turnaround but this is an actively managed fund, and this is the best they can do? It would be far less risky just looking at what they are invested in and pick a few stocks from their holdings that make sense then to actually invest in their ETF. I will continue to search for more but I think the above is more than enough for the time being, especially as most are not new to us so likely most already have positions in the likes of Tesla and MSTR as well as the 4 miners. AI Tech Stocks Portfolio My portfolio has undergone it's biggest update in a year wehre the biggest change being the rise of TESLA to become a PRIMARY stock due to bot's set to send the Tesla stock price into the stratosphere, yes there is the risk that Musk does something insane but for now Tesla is where the infrastructure for the bot's resides and thus I have been busy accumulating a position, it does not really matter if one buys at $193, $213, or $163, the main thing is to actually have a position. 2. KLA - Promoted to Secondary. The rest of the portfolio reflects the inclusion of the four metals and miners, though for the time being I'll keep Hershey's out of the portfolio proper as it is rather an odd stock, treat it as a trade for now and see how things go. Note NEW spreadsheet link - https://docs.google.com/spreadsheets/d/183aPw1ztElfFT9c2Ch9vKk1uL3LTGiEaNsM6vaHxDQM/edit?usp=sharing The old link is no longer being updated as of 2nd of Feb so to access the current spreadsheet use the above link which should be good for a couple of months. China the Worlds Most Hated Stock Market How's the worlds most hated stock market doing? Chinese stocks! Hang Seng put in a NEW LOW. There are infinite reasons for why China stocks are finished and only one why they aren't which is that they are CHEAP!

Alibaba $72 EGFS +10%, +0%, PE 8, PE Range -15% = Cheap! Yes they can get even cheaper, this is what investing in the stock market is like when stocks are cheap no one wants to buy because all one sees in the rear view mirror is BAD NEWS! The stocks just need to start growing their earnings and their multiples will expand sending the stock prices sharply higher. Lets see where they are in a few months now, a year from now, I'd happen a guess that they will be trading a lot higher than where they are today. The whole of this analysis on how to capitalise on the Climate Change Global warming megatrend - How to Profit from the Global Warming ClImate Change Mega Death Trend was first been made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your very last chance to lock it in now at $5 before it imminently rises to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. Latest analysis -Stocks Correct into Bitcoin Happy Thanks Halving - Earnings Season Buying Opps Here's what you get access to for just $5 per month - ※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox. ※A concise to the point Investing Guide that explains my key strategies and rules ※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings. ※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook. ※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact. ※Join our community where I reply to comments and engage with patrons in discussions. So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's. And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis. Your crypto's accumulating analyst. By Nadeem Walayat Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | |||||||||||||||