Time to take the RED Pill! Dear Reader Crackup boom + US Dollar black hole that some call the US Dollar Milkshake = Everyone on the planet is buying US assets! After all the US is the worlds sole Empire, Britain and most western nations are vassal states of the Empire to varying degree with much of the rest slave states with the illusion of democracy and freedom. I don't even watch UK political news anymore because it is largely irrelevant, they have NO POWER! and neither do US Presidents! The Imperial Machine that goes by several names such as the Deep State controls the world! If you understand this then you know what to do! Resistance is futile! You cannot beat the Imperial machine so embrace it with open arms and profit from it's actions especially as it's fast morphing into an Imperial AI machine. Stock Market Trend Forecast Folk ask when will the S&P index correct? This is the problem when investors stare at the S&P they MISS the corrections in key target stocks! Google fell to $130. down 15% from it's high as I pointed out at the time as I accumulated more that it would likely soon reverse higher to target $160+, and then there is TESLA that traded down to a DEEP 47% deviation from it's $299 bull market high, with a dozen more opps to accumulate into, the likes of Redfin, Flex, Apple, ALB, BHP, CCJ, DIODE, GFS, Baidu, BDEV, Corsair, Unity and so on all whilst most remained focus on the S&O.... I keep saying to forget about the indices and focus on the individual target stocks but folk keep making the same mistake of waiting for the S&P to move before they decide to act. The S&P is just a cap weighted average, it does not reflect what most target stocks are doing and thus opps to buy and sell get missed by staring at the S&P nothing burger. The S&P should be treated as a stand alone market to trade or invest in.. Stock Market trend forecast for 2024 is for the S&P to target a trend to 5376 by the end of the year, along with to expect upto 3 corrections with target swing lows in March, June and October. S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

This article is part 1 of 2 of my recent extensive analysis - Stock Market, Interest Rates, Crypto's and the Inflation Red Pill which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. Contents Stock Market Trend Forecast S&P 5149, index that is the focus of most is showing relative strength against the trend forecast despite many target stocks having experienced deep corrections i.e. Google 15%, Tesla 47%. which implies - 1. That the S&P looks set to surprise to the upside by trending to well beyond the target of 5376 to likely see a year high above 5600. 2. That the failure for a correction to materialise increases the probability for the subsequent two corrections i.e. last year there were 2 corrections, so the highest probability was to expect at least 2 corrections this year with a third correction being more probable than not and given that last year the June correction failed to materialise then this year implied either March or October could fail to materialise, well now we know which correction failed materialise. 3, Corrections being the operative word, remember we are in a BULL MARKET where last years two deep corrections in percentage terms spoiled us to some degree i.e. conditioned us to expect corrections of similar magnitude going forward. The S&P's strength going into Mid March is in stark contrast to 2 months ago (Mid January) when many were panicking in the wake of the Church of the Almanac Trifecta nothing burger (Stock Market Election Year Five Nights at Freddy's ), the January dip triggering much fear. In terms for the immediate prospects, the S&P is very over extended both in terms of price and time, but it is NOT correcting, and so it could weakly continue snaking higher into early May which would chime well for Sell in May and go Away which tends to fail more often then not, i.e. it failed for 2023 and the 2022 bear market, AND for 2021 and 2020! That's four years in a row when the Sell in May and Go Away mantra FAILED to deliver! So four failures in a row should increase the probability for a hit thus year, especially as the INDEX failed to correct in it's Feb to March window and so is setting the scene for a correction during May and June.

(Charts courtesy of stockcharts.com) Extrapolating the relative strength further out then preliminary analysis suggests that the S&P could blast through 6000 to trade to above 6100 before the end of next year. So all whilst most fear investing because a big drop could just be around the corner what they will actually witness is a relentless 2 year bull market ahead of them.

Swings Analysis S&P swing topped at 5189 on 8th March, up 64 days from the 4th Jan swing low which suggests to expect short sharp minor down swing into late March, targeting 5040 before the next swing higher into early May to 5300+ for a more significant correction. during May and June. How deep? Depends on where the S&P tops out i.e. if the last high of 5189 manages to hold then I would expect the correction to target 4800 for an approx 7% correction, if from a 5300 top then targets a 7% drop to 4930 during May-June. Bottom line we are in a bull market and in a bull market stock prices tend to go up, thus if you see a deviation from the high in target stocks. don't over think things because such price action is living in borrowed time as we saw with Google which I pointed out at the time that Google had corrected 14% down to $130, so even if the S&P did correct its more probable than not that Google will be higher than where it is now given that it has already corrected. AI Stocks Portfolio Portfolio is now 76.7% invested, 23.3% cash with the changes largely due to selling 89% of my MSTR holding during it's FOMO climb that topped out at $1865. https://docs.google.com/spreadsheets/d/xxxx patrons only Stocks in or very near buying ranges worth accumulating are - Tesla, Intel, CCJ, ALB, OXY, FSLR, Diode, IIPR, Redfin, Roblox, Unity, Docu, GFS. SYNA, MSTR, BDEV Of particular note are Tesla, CCJ, U, Roblox and of course MSTR. In terms of trimming, SMT is enjoying a buyback rally allowing one to lighten ones position, TESLA $172 A patron commented - Nadeem, why is TSLA getting punched by all the analysts. Today Wells Fargo predicts a further 30% downside risk. This illustrates that after stocks have fallen the analysts get bearish, and after stocks have risen then the analysts get bullish. Tesla at $280 - "Wells Fargo raises its price target on Tesla. Here’s what the pros are saying" https://www.cnbc.com/2023/07/17/wells-fargo-raises-teslas-price-target-heres-what-the-pros-are-saying.html What a bunch of clowns, at $280 Wells Fargo raised their target for Tesla then AFTER it's fallen by $120 to $160 they say it's going to drop by another 30%! My view as of $280 is that Tesla is targeting a trend to sub $160 where I have continued to accumulate as the stock price has fallen below $200. In fact Tuesday I decided to get the job done and bought 25% at $168 to lift my exposure to 100% invested (spreadsheet update pending). Yes it could fall to $150, but we will only know in hindsight, and if it does I'll likely add another 5%. And you know my big picture view for the next 10 years, Tesla's going to at least X10! And likely X20! When the robot armies start marching out of the giga factories.

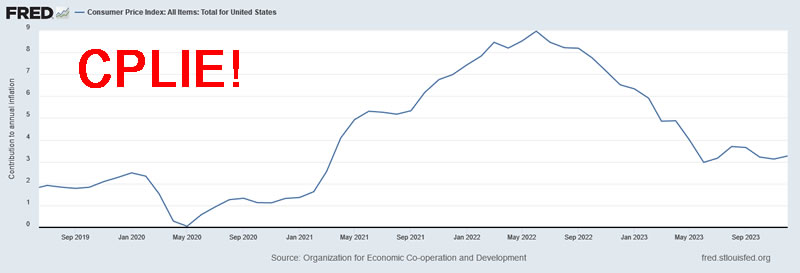

Deviation from Highs - Upside potential - That's my focus when accumulating Tesla. What difference does any draw down make if it is temporary? But what if it's not temporary? Welcome to the world of investing in the stock market! Cannot get the X2 to X3 returns without the risk of deep draw downs. A further boost to Tesla was Apple throwing in the towel after having wasted $10 billion on attempting to develop it's own self driving EV. And it looks like it's given up on trying to play catchup to the LLM's by partnering with Google to embed it's LLM's into it's products, with details to follow. Meanwhile Tesla released GROK as open source, but who is going to download and install 314gb of files when they can already use it in a browser for $16 per month. There is a cost in terms of compute resources and time vs paying 16 bucks for a month to try Grok out. Why US Interest Rates are a Nothing Burger All eyes today will be on the Fed and it's interest rate decision, weren't we supposed be having a cut in March? That's gone! Kicked down the road. So no rate cut today or at the next meeting nor likely in June. And each time the Fed holds the MSM clowns cry stocks must fall due to failure for rate cuts to materialise all whilst the bull market continues to relentlessly grind higher. Everybody is obsessed with when will the rates be cut without understanding why rates should be cut! Why should rates be cut? Because CPI is falling? Or was falling.... Well that CPI is a LIE! CP LIE! A made up fake inflation index. For rates to actually fall there needs to be a reason other than it will make life easier for home owners and speculators. One major reason to drop rates would be if the Dollar was going up, is the Dollar going up?

Nope the US Dollar has been stuck in a trading range for the duration of this stocks bull market. The stock market likes a stable dollar. not a strong or weak dollar, a stable dollar. So why cut interest rates when the Dollar is stable and the markets like it that way. There is no reason in terms of dollar trend to cut interest rates, Whilst the Fed barks about how inflation is now mostly under control by waving fake CPI lie in everyone's face. However INFLATION = ASSET PRICE INFLATION - That's stocks and housing which given their trends suggest that Interest rates should be HIGHER NOT LOWER! What about to Create Jobs?

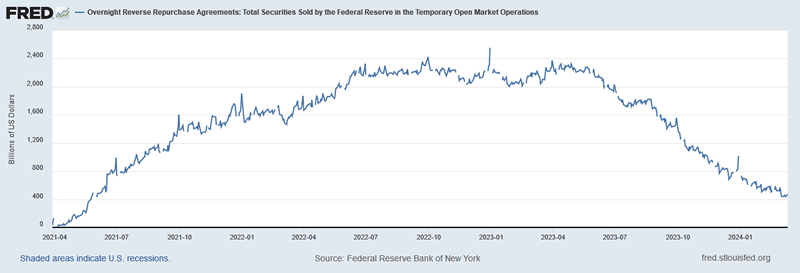

Does the US unemployment graph look like it warrants lower interest rates to create more jobs? I could go on and on, but apart from clowns on the cartoon network banging their fists demanding lower rates NOW, there isn't any significant reason to lower rates. I mean if stocks are rocketing higher despite higher for longer then does that not tell you the MSM rates cuts are coming mantra is just another one of those nothing burgers such as the fact that a recession has always been imminent since early 2022. So I think focusing on interest rates is a red herring as market price action is telling us that interest rates are TOO LOW! The clowns say interest rates need to be cut so that markets can become risk on once more, then what the hell do you call what Bitcoin has been doing if that is not a sign of MARKETS being RISK ON! Where markets are concerned nothing is certain but the fact that the consensus is waiting for rate cuts to get the party started illustrates once more that the consensus is WRONG! The party has been underway for over a year with no end in sight as all those sat on the side lines desperately seek a big price dump so they can buy and will increasingly admit defeat and join the party while they can! It is definitely impossible for ordinary investors to make money because the MSM clown journalists are always pointing them towards looking in the WRONG direction because they don't have a clue what to actually look at and thus everyone is staring at nothing burgers all whilst the markets rip higher! The next nothing burger will be another banking crisis! UNDERSTAND INTEREST RATES ARE TOO LOW! IT'S MORE LIKELY AT SOME POINT THE FED WILL BE FORCED TO RAISE RATES NOT CUT RATES GIVEN ASSET PRICE INFLATION. Stocks Bull Market Smoking Gun One of the comments I receive is that the Reverse Repo liquidity pool getting drained,, won't that mean that the stock market then hits a brick wall?

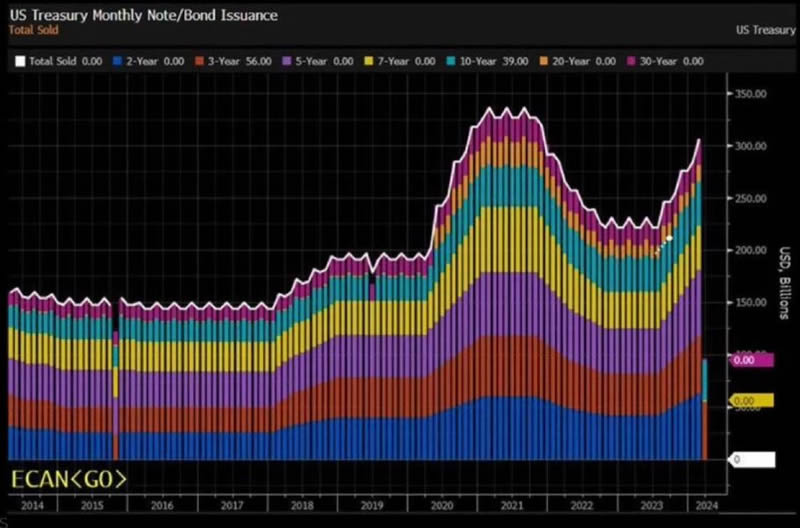

Firstly, whilst the US is primary it is the sum of global liquidity that matters in which respect the world is awash with liquidity that the US tends to suck in like black hole into US assets by virtue of being the worlds reserve currency. However, this once more highlights not to fixate on just one aspect of the rampant money printing underway, as this chart of US debt issuance illustrates. You can see the smoking gun for the stock bull market trend in this chart the 2020,2021 soaring stock prices, the 2022 bear market, and the 2023 new bull market followed by the strong first few months of 2024. Remember that the printed money eventually finds its way INTO asset prices, i.e. if the government prints $10 and gives it to you to go spend on a cheese burger then that $10 doesn't get eaten, it gets distributed by Mcdonalds, it's workers, suppliers and share holders, eventually ending up in assets as the final destination for printed money, either that or inflation will erode that $10 bucks to nothing as the government keeps printing more dollars. The above chart tells you why stocks are going much higher than most imagine as I mentioned earlier. And the amount of debt issuance is only going to go UP! There is no trough around the corner, one only needs to go and take a look at the US Governments accounts to see that INTEREST PAYMENTS are now 28% of total tax receipts and rising! That's more than 1/4 of taxes going to be pay interest! This is why the Fed engineers FAKE inflation statistics so as to prevent hyper inflation, most people have been well and truly brainwashed by MSM to swallow the lies that they are fed on a daily basis! INFLATION IS HOW THE GOVERNMENT STEALS THE PURCHASING POWER OF YOUR EARNINGS AND SAVINGS SO THAT YOU REMAIN A SLAVE TO THE SYSTEM YOUR WHOLE LIFE! Time to take the RED Pill

INFLATION IS HOW WE BEAT THE SYSTEM! BY BEING INVESTED IN ASSETS THAT INFLATE FASTER THAN THE RATE OF GOVERNMENT STEALTH INFLATION THEFT LOSS OF PURCHASING POWER OF FIAT. We just did it with Micro Strategy, typically magiced x3 of what we invested in the stock out of thin air! WE BEAT THE SYSTEM! THIS IS THE REVOLUTION! BEATING THE GOVERNMENT AT IT'S OWN GAME INFLATION GAME! This is what we do when we invest in assets that are LEVERAGED to inflation - Housing, AI tech stocks, crypto's and so on, we are WINNING the WAR against THE SYTSTEM! Don't be under any illusion ALL GOVERNMENTS ARE EVIL! They want you to be SLAVES in their SYSTEM where you work for peanuts and will own nothing through a myriad of mechanisms! Unfortunately. ordinary folk are screwed, they have been well and truly brainwashed, drunk too much of USA USA USA, or to a lesser extent UK UK UK coolaide. Both operate systems of slavery in the service of the Elite! And don't think any other nation is any better, likely much worse! CHINA for instance! A real world Neo does not dodge bullets in bullet time. A real NEO at the checkout does not flinch whatever the checkout bill totals, it's just a made up fiat number because you are awake and have hacked the system! The Inflation bullets run too slow to hit you, easily dodged, your wealth is increasing at a rate well beyond CPI so the more inflation the richer you get. Understand asset prices going UP is INFLATION! Take another red pill and you will conduct your Inflation combat activities from within tax free wrappers and thus defeat the System in it's other mechanism to steal your wealth - TAXES! So we are not just surviving the inflation pain that most of the slave population faces each day but exist outside of the INFLATION / TAX MATRIX. The higher the inflation goes the more detached we become from the prices in the shops. Most people are blind to the extent that they are in a losing war against Government Inflation.

The government says here look at the annual rate of inflation, it;s only 3% now so all of last years inflation pain is now gone. What a con! The only way to win in the Inflation War is by being invested in assets that are leveraged to inflation. Corporations fight the war by increasing the price of goods and services AND with SHRINKFLATION. The Economists and Politicians are the Governments INFLATION soldiers, Working for the governments and their Elite puppet masters. As rebels in the Inflation war we win when we do what the Elite do to get richer! WE BUY ASSETS THAT ARE LEVERAGED TO INFLATION! WHEN PRICES GO UP THAT IS GOOD FOR INFLATION REBELS BECAUSE THAT INFLATION WILL PUSH UP OUR ASSET PRICES! Just look at what the S&P has done this year let alone crypto's! You don't get any of that without INFLATION as a consequence of rampant money printing. INFLATION IS GOOD FOR US! BAD FOR ALL THOSE WHO HAVE YET TO TAKE THE RED PILL. So when I see my £500 Tesco checkout bill I don't grimace at the fact that prices for everyday goods have DOUBLED since the Pandemic, Instead I think of how all of that lovely money printing inflation is inflating my asset prices that make grocery bills dissolve into nothing. HACKED THE SYSTEM! As I have been writing for 2 decades there can NEVER BE ANY SUSTAINED DEFLATION BECAUSE THE GOVERNMENTS NEED INFLATION TO INFLATE THEIR DEBT MOUNTAINS AWAY! The money printing is perpetual with out end. So whilst governments can fiddle inflation measures such as CPILIE to make them meaningless, they cannot mask the real world impact of the money printing which will eventually make its way into RAISING ASSET PRICES as that is the final destination of printed money! What to do to work your way up the Inflation Rebel Army Ranks - 1. Own the house you live in, it's the easiest route for most ordinary folk, tax free. And if your upto doing the work acquire properties for rentals as a business. 2. Invest in Good AI tech stocks that you understand what they do i.e. how they grow their revenues and profits so you know no matter what the draw down eventually they will trade to a new all time high because of the INFLATION! 3. BITCOIN - Crypto's are an epic leveraged to Inflation hack., Whilst BTC may eventually X10 off it's low many ALt's have already X20! (Solana). 4. Accumulate assets that cannot be printed and that you have good knowledge of, i.e. not running off to buy junk after watching a youtube video, such as investing in some scam like Masterwork fractional paintings or fake gold coins. 5. I DON'T BORROW MONEY BUT fixing a loan at a low rate will get eroded away by INFLATION. It all depends what you do with the money, Buy a House YES, Buy a Car NO. And one day you too could become a Five Star General in the Inflation Rebel Army!

At the end of the day you want to avoid holding fiat currency. See my How to Get Rich Guides on how to hack the system turn Inflation to your advantage. Change the Way You THINK! How to Really Get RICH Guide 2023 Learn to Use the FORCE! How to Really Get Rich Part 2 of 3 The Investing Assets Spectrum - How to Really Get RICH This article is part 1 of 2 of my recent extensive analysis - Stock Market, Interest Rates, Crypto's and the Inflation Red Pill which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat. Contents Stock Market Trend Forecast Latest analysis - AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming... CONTENTS Here's what you get access to for just $7 per month - ※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox. ※A concise to the point Investing Guide that explains my key strategies and rules ※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings. ※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook. ※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact. ※Join our community where I reply to comments and engage with patrons in discussions. So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's. And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis. Your crypto's accumulating analyst. By Nadeem Walayat Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | |||||||||||||||