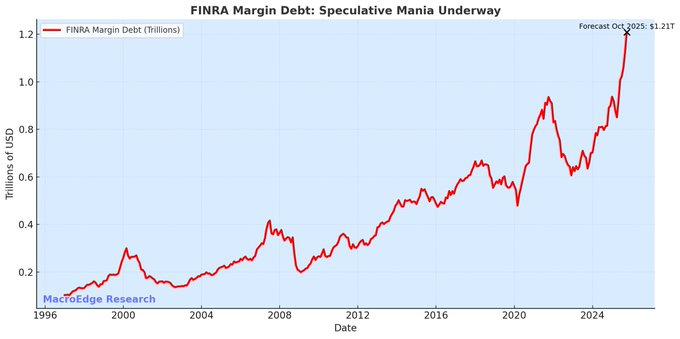

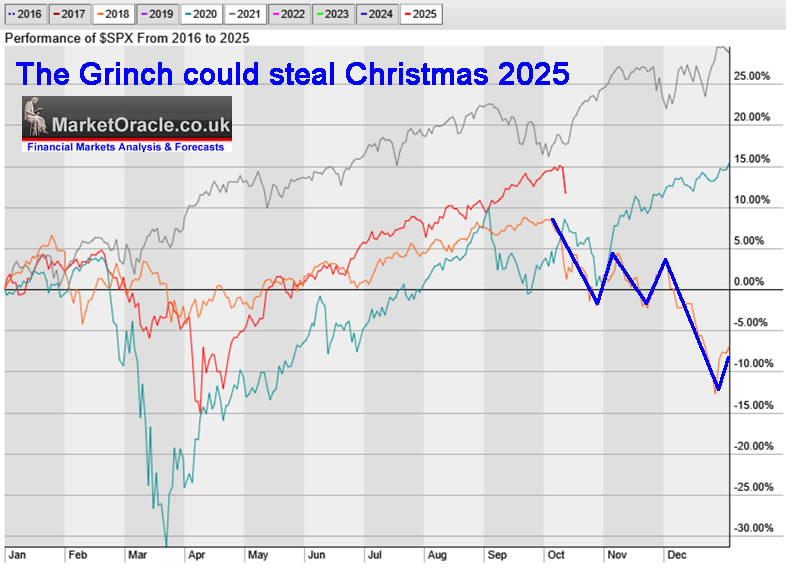

Bipolar Stock Market FOMO into AI Earnings and US Rate Cut Dear Reader Happy Halloween! Contrary to popular belief everyone with a brain cell knew in 2000 that it was a bubble but they bought and held on anyway! Even the poster child IPO was well named for the top, Lastminute.com, yeah that's how it felt like at the time, lastminute to make money on the bubble before it bursts. It was like lemmings who knew what was coming but leapt off the cliff anyway. Everyone today knows that the stock market is in a bubble but folk are buying and holding on anyway as Quantum AI Mania takes hold of folks senses. I mean folk have regrets of selling some Nvidia at $197 because they see it next trading at $207 and then contemplate buying back at a HIGHER price, the Nvidia FOMO train is adding an AMD in market cap with every 10 bucks it goes up! I was telling panicking folk at $120, that Nvidia's going to 2x to $240 with the $200 way point along the way now achieved, now $240 is not so far away! FOMO! FEAR OF MISSING OUT! It's all psychological, little to do with the math which is screaming SELL for most AI stocks! One only needs to look at the spreadsheet PE percent of range columns to see how expensive most AI stocks have become, and the FOMO indicator to see how much future earnings growth is already baked in the current price which means earnings beat mean little in that it's FUTURE fantasy expectations that are driving stocks higher, we only need look at the Tesla hype train for that! I remember buying the Lastminute dot com IPO even though I knew I was likely buying into the top, I told myself no one knows WHEN the bubble will pop, so it could keep inflating and thus allow one to cash out on the hype stocks. And even if it bursts it will be temporary i.e. looking back one saw the 1987 crash in the rear view mirror. Instead what we got was a lost decade, 2007 wasn't really a stock market bubble because most folk weren't into stocks at that time, housing was what they were all gambling on and it was the housing crash which got them all broke! And here we are once more trading at new all time highs in over valued stocks looking in the rear view mirror at corrections and crashes that quickly resolved to new all time highs, eager to buy the dips, any dip will do! FEAR OF MISSING OUT! How can stocks keep powering higher? Retail FOMO, once the numbers have been crunched there will likely be record buying underway, in excess of $300 billion year to date. One only needs look at the ease at which folk can trade nowadays, commission free through a multitude of app's. Retail - The last to join the bull market. Then there is the buyback's SCAM! It's a scam because this is one of the primary mechanism the rich avoid paying TAX, what used to be paid out as dividends which are subject to income tax since 1982 have been used to buy back shares and thus inflate the share price without any tax consequences for the holders. Buy backs for 2025 will total OVER $1 trillion! Passive ETF Investors - That's another $1 trillion of inflows. The herd blindly auto investing into S&P ETFs, pushing up the value of the over weight large caps, the Mag 7 expensive stocks that get even more expensive due to blind investing without regard to valuations metrics. Then throw $1 trillion of margin debt into the equation and that's what's pumping stocks higher regardless of valuations. Margin debt deleveraging will be the smoking gun that drives the coming CRASH / BEAR as levered longs are forced to SELL triggering waves of panic selling.

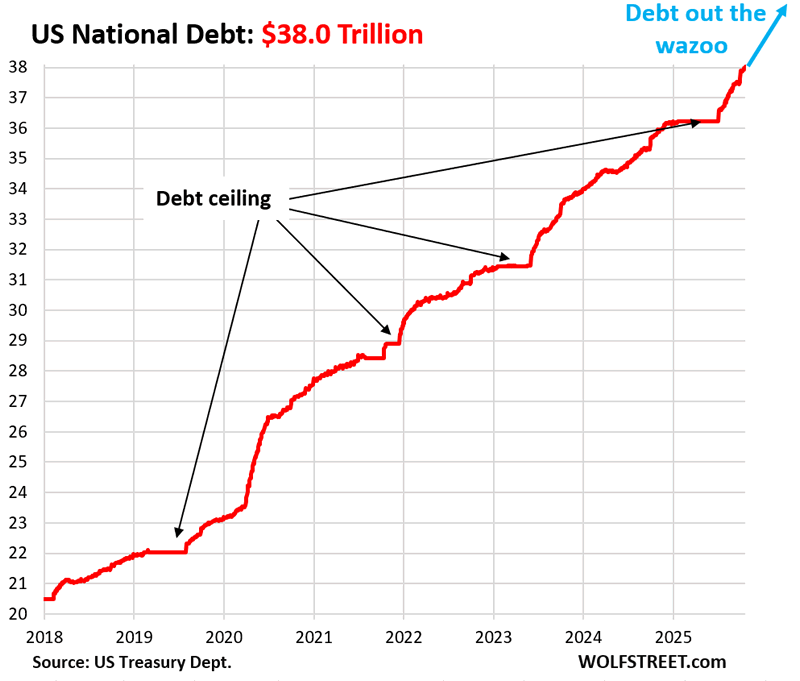

How bad things get depends on what else goes wrong along the way, I mean it's not as though the current President is announcing 100% tariffs every other week, unlike the fools from the early 1930's.... Then there's the banking crime syndicate, we will only really know what they have really been upto when the music stops and the tax payer is forced to step in to bail them out once more. So how bad things get depend on how many mistakes are made along the way... So one has a choice, one can either join the herd and blindly FOMO rush over the edge of the cliff, or one can act intelligently by reducing exposure as stocks become ever ever more over valued, the likes of AMD, TSMC, AVGO, LRCX and so on. Folk should understand that the RUG WILL GET PULLED! All the paper profits that bipolar investors are making in their MANIC HIGHS will resolve into DEPRESSION LOWS unless folk take their med's and TAKE PROFITS which is what I have been doing all the way to being 66% cash where the latest stock to join in on the mania was QUALCOM. On the brightside the coming stock declines will be temporary, why? because of CURRENCY DEBASEMENT! The dollar all currencies are in perpetual free fall where the fx rates are just the differing rates in free fall between currencies. If there was very little currency debasement then the indices would trade in a range for decades! Instead the currency debasement is on an epic scale, all whilst US politicians play the smoke and mirrors debt ceiling game, it's just a show for the gullible masses, there IS NO DEBT CEILING!.

20,000 ETFS! ETFs of ETFs even! All creaming a percent management fee! That's the dynamics of today's stock market bubble, passive investing into ETF black holes. In the past it was investment trusts, today it's ETFs! MSTR has become an crypto investment trust! At the top all of the news is good. At the bottom all of the news is bad. Remember Clown Cramer October 2022, "The MAG 7 are FINISHED, META at $100 is FINISHED!" My stock market view remains as per previous article, so all's I am doing as stocks pump is to trim the likes of NVDA, GOOG, AVGO, LRCX, as they pump to new all time highs.

Bipolar Stock Market FOMO into AI Earnings and US Rate Cut CONTENTS The rest of this analysis was first made available to Patrons who support my work early Wednessday 29th Oct. For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat. Your trimming the rips analyst to only buy the dips when CHEAP! Recent extensive analysis - The OpenAI Stock Market AI Ponzi Bubble Mania into 2026 IPO CONTENTS Stock Market Fomo Mania Into US Rate Cut Controlled Demolition Event

Jackson's Black Hole, Will Nvidia Earnings Spark Panic Event in Correction Window?

Stock Market Smells like 2021, US Housing Market Analysis For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat. And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series. Change the Way You THINK! How to Really Get RICH Guide Learn to Use the FORCE! How to Really Get Rich Part 2 of 3 The Investing Assets Spectrum - How to Really Get RICH It's simple, you pay $9 and you get FULL access to ALL of my content - ※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox. ※A concise to the point Investing Guide that explains my key strategies and rules for successful investing. ※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings. ※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook. ※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact. ※Join our community where I reply to comments and engage with patrons in discussions on a daily basis. For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $9 per month, lock it in now at $9 before it rises to $12 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat. And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis. Your buy the dips and sell the rips analyst. By Nadeem Walayat Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone this link To update your preferences this link How to Unsubscribe - this link

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. | |||||||||||||||